Zander Life Insurance Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

It may seem curious that I’m doing a Zander Insurance review, since they aren’t one of the life insurance companies we work with here at Insurance Blog By Chris.

In fact, they aren’t even a life insurance company at all, but a life insurance agency, which technically makes them one of our competitors.

But we’re all about the life insurance industry, and put our customer’s needs first – even if that means doing a review on one of our competitors.

Zander Insurance is one of the major insurance agencies in the country, and definitely worth a discussion on our blog.

That being the case, our attempt in this Zander Insurance review will be to evaluate the company – both its advantages and disadvantages – as objectively as we can.

In This Review:

About Zander Insurance

Based in Nashville, Tennessee, Zander Insurance has been in business since opening way back in 1925.

Though we’re focusing on life insurance products in this review, the company is actually a diversified, full-service insurance provider.

In addition to life insurance, they also offer coverage for:

- Disability Insurance

- Homeowner’s Insurance

- Auto Insurance

- Health Insurance

- Long-Term Care Insurance

- Various Types of Business Insurance

- Identity Theft Protection

Zander Insurance is frequently endorsed by Dave Ramsey and has been for over 20 years.

On the website, he’s quoted as saying “I trust Zander with all my insurance needs”. If Ramsey is an actual customer of Zander Insurance, that’s just about the best endorsement there is.

But Zander isn’t a direct insurance provider. Instead, it’s an independent insurance agency, and one of the largest in the country.

They work with some of the biggest names in the insurance industry, including:

…and many others. When you make an application with Zander Insurance, they work to place your application with the company they feel is the best match for you based on policy and price.

Zander Insurance has a Better Business Bureau rating of “A+”, their highest rating on a scale of A+ to F.

Since it’s not a direct insurance provider, the company is not rated by A.M. Best or the commercial credit rating agencies.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Life Insurance Products Zander Offers

Despite being an insurance agency and working with many different insurance companies, Zander Insurance offers only term life insurance policies, not permanent or cash value policies, like whole life or universal life.

However, since they work with several different companies, the specific term life insurance policies available are based on those offered by participating insurance providers. Zander Insurance has no proprietary life insurance policies available.

Applying for Life Insurance with Zander

The only way to determine what products they have available is to complete an application. Fortunately, that’s a simple one-page application that gets the quote process moving.

There are four basic questions you’ll have to complete on the application:

- Have you used tobacco in the last 12 months?

- Select Your Health Class: Preferred Plus, Preferred, Standard Plus, or Standard

- Coverage Amount: Ranges from $50,000 to as much as $10 million

- Length of Term: The choices are 10, 15, 20, 25, and 30 years

Question #1 is a standard question on any life insurance application.

Question #3 indicates the company has a very generous range of death benefits, going all the way up to $10 million.

Question #4 shows Zander offers the typical term policy lengths, ranging from 10 to 30 years in five-year increments.

But Question #2 is more than a bit curious. It asks you to provide a self-evaluation of your health, based on the four traditional life insurance health ratings. Unless you know exactly what each rating entails, it’s highly likely you’ll make the wrong selection.

What’s more, the application doesn’t give any indication the company accepts applicants who may rate as substandard health risks.

In such cases, life insurance companies typically assigned what’s known as a “table rating”, ranging from 1 to 10.

The numeric rating represents a percentage increase in the premium you will pay above the rate for a Standard classification. The higher the table rating, the higher your premium will be.

The fact that the substandard option is not presented in some form opens the possibility that Zander may not provide life insurance policies for those in less than standard health.

However, it’s equally likely that a substandard rating will be assigned once a fully completed life insurance application has been submitted, and a health evaluation has been performed.

You simply won’t be able to get a quick quote for coverage through the website, or at least not one that will be your final policy and premium.

This arrangement is not unusual in the insurance industry.

Zander Costs

With so many different life insurance companies participating, and the various policies each offers, it’s virtually impossible to provide a summary of all policies available through the company.

But for pricing purposes, I did run several scenarios:

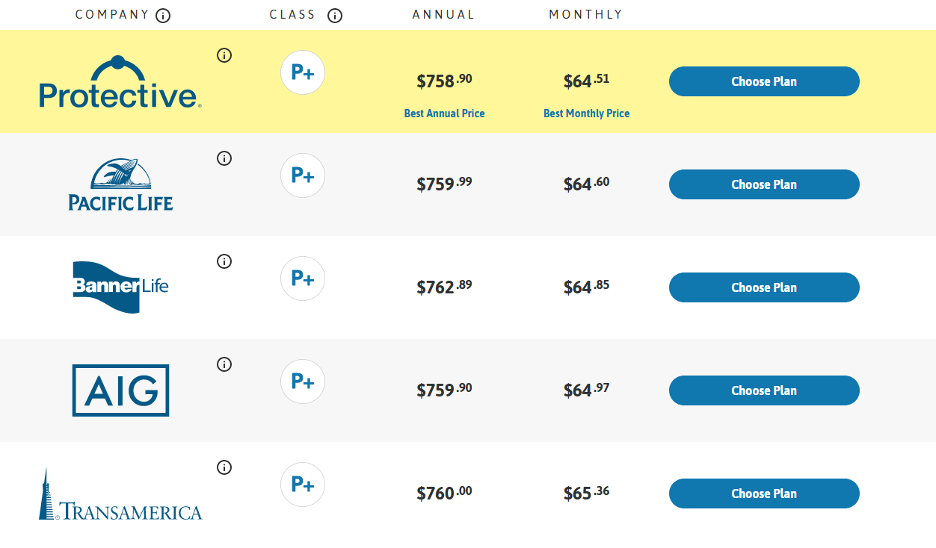

Scenario #1:

- Applicant: Male, 35

- Health status: Non-smoker, Preferred Plus

- Coverage amount: $1 million

- Length of term: 30 years

The top five quotes came in as follows:

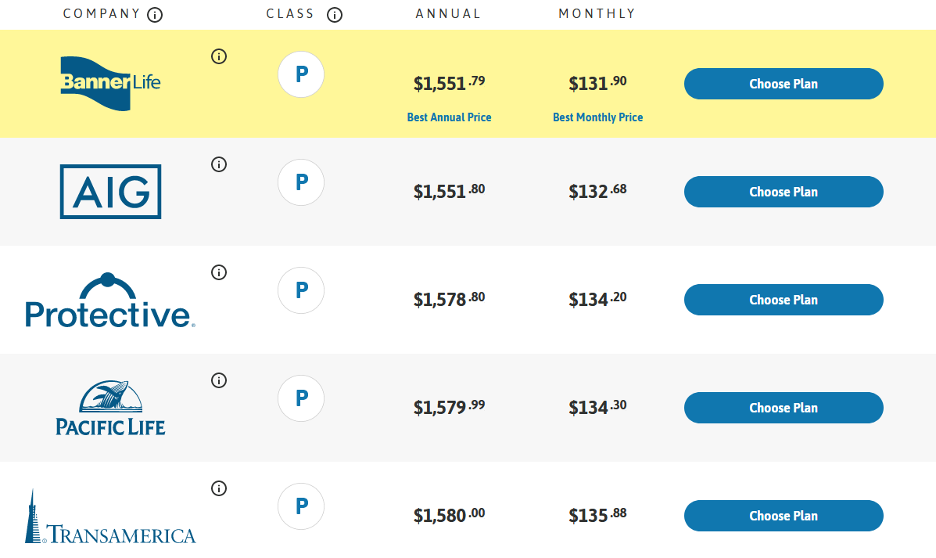

Scenario #2:

- Applicant: Female, 45

- Health status: Non-smoker, Preferred

- Coverage amount: $1 million

- Length of term: 30 years

The top five quotes came in as follows:

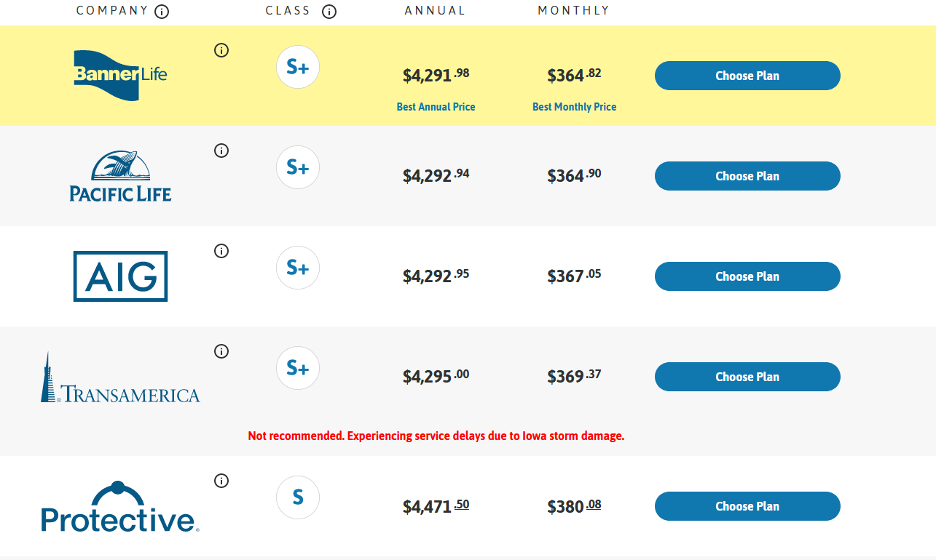

Scenario #3:

- Applicant: Male, 55

- Health status: Non-smoker, Standard Plus

- Coverage amount: $500,000

- Length of term: 30 years

The top five quotes came in as follows:

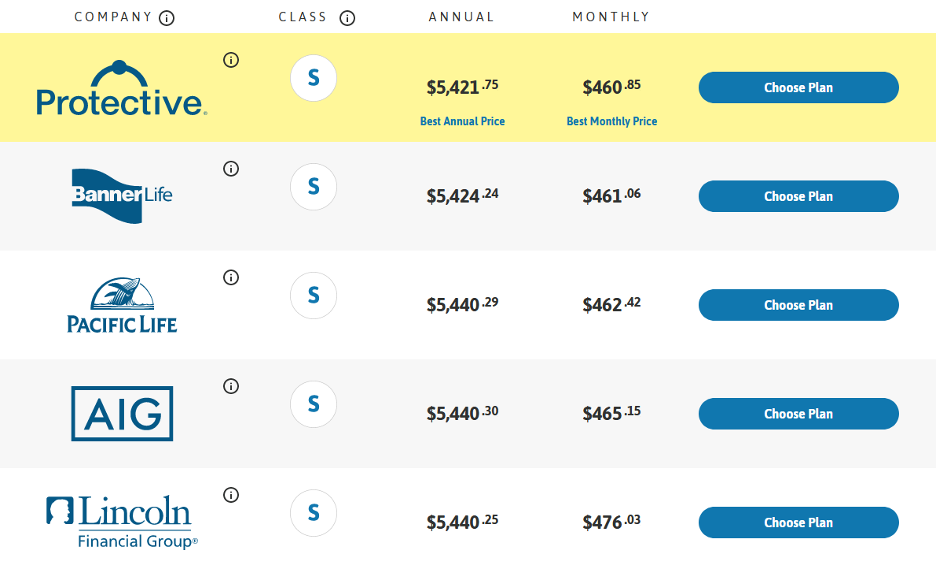

Scenario #4:

- Applicant: Female, 65

- Health status: Non-smoker, Standard

- Coverage amount: $500,000

- Length of term: 20 years (a 30-year term for a 65-year-old requires calling in for a quote)

The top five quotes came in as follows:

It’s important to remember that all you are getting when you complete the brief online application is a series of quotes from participating insurance providers.

Once you select a quote and company to make a full application with, the details may change based on your health status as determined by the insurance company.

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Zander Life Insurance Pros and Cons

Pros:

- Zander Insurance is a fully diversified insurance company, offering nearly every type of policy in addition to life insurance. If you’re looking for a company that will meet multiple insurance needs, Zander is one worth checking out.

- As a life insurance agency, you’ll have access to quotes and policies from many different life insurance companies. You can choose the one that will work best for you.

- The application process, at least as far as getting rate quotes, is extremely user-friendly.

- The company is endorsed by Dave Ramsey, and has the top Better Business Bureau rating.

Cons:

- Zander Insurance is not a direct insurance provider, so you will ultimately be dealing with the participating life insurance companies.

- The company emphasizes term life insurance, and doesn’t even promote permanent or cash value life insurance policies.

- No indication is given if they offer no medical exam policies. But it is possible they are offered on a company-by-company basis.

Alternatives to Zander Life insurance

The life insurance industry is one of the most diverse industries there is, which means you as a consumer will have plenty of options to find the right policy to meet your needs.

Other companies we recommend include:

AIG Direct

AIG Direct Life Insurance isn’t one of the better-known life insurance companies, at least not among the general public.

But it is one of the bigger providers of individual life insurance in the industry.

Similar to Zander Insurance, AIG places your policy with one of the many participating companies they partner with, offering you an opportunity to get a good policy for a very reasonable premium.

And in addition to term life, they also offer whole life, universal life, guaranteed issue and other policies Zander doesn’t provide.

Banner Life

Banner Life Insurance is one of the most popular life insurance options in the industry.

It’s a subsidiary of Legal & General, one of the largest insurance companies in America.

Banner Life is frequently one of the lowest cost providers in the industry, which explains why they’re so popular.

They also offer permanent life insurance and annuities in addition to term coverage.

Banner also offers no-medical exam policies, which while higher priced than fully medically underwritten policies, they’re good for anyone who isn’t fond of exams.

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

Ladder Life

Ladder Life Insurance is a favorite around here.

It’s one of a new breed of “fintech” life insurers, operating entirely online, and offering fast approvals at reasonable rates.

But they’re also one of the most unique life insurance providers there is.

As the name implies, they offer life insurance that allows you to adjust the amount of the death benefit, based on your financial needs and budgetary constraints.

For example, you can start with a large amount of inexpensive term coverage when you are younger but reduce the benefit as you get older and your need for life insurance decreases.

This will also give you an opportunity to reduce the premiums, since term renewals are based on your age at the time of renewal.

USAA Life

USAA Life Insurance is a full-service provider of financial products and services to members of the US military and their families.

These include investments, retirement plans, banking, loans, mortgages, auto insurance, and, of course, life insurance.

If you are eligible, they offer some of the most competitively priced life insurance products in the industry.

It should be your first stop if you are a member of the military.

Is Zander Best for You?

Maybe that’s a strange question since Zander is a competitor. But we feel our customers owe it to themselves to investigate several options to find the right life insurance policy.

We certainly hope you’ll choose us, but should you decide to go elsewhere, we wish you the best of luck. And certainly, Zander is one competitor worth checking out.

Just remember that, like us, they’re not a direct life insurance provider, but an agency placing your policy with one of several major life insurance companies.

As best we can tell, Zander targets those who fit the Standard health rating or higher. It’s likely they offer very competitive premiums if you qualify.

But if you don’t – usually because of a health condition – please remember that’s our specialty. As life insurance brokers, we work specifically with people who have health conditions, high-risk occupations, and even high-risk hobbies.

If any of those situations described you, just complete the Get a Free Life Insurance Quote box to the right of this article and let us get to work helping you to get the best coverage at the lowest possible premium.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.