20 Year Term Life Insurance | Pros & Cons

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Here’s the truth about life insurance agents: While a 20-year term policy will do the job for 90% of Americans, many agents will try to sell you 30-year term policies or whole life policies.

They make more money that way!

In this guide, I’ll share why a 20-year term may be just enough insurance coverage for you.

Table of Contents:

What is 20 Year Term Life Insurance?

A 20-year term life insurance policy locks in level premiums for 20 years. Your death benefit would also stay the same during your 20-year term.

It’s one of the simplest forms of life insurance on the market. You pay the premiums and, in exchange, your beneficiary could receive your insurance coverage if you died. No bells or whistles.

Our clients often buy a 20-year term when they aren’t sure what the future holds. A 20 year term gives the policyholder time to figure what your needs will be down the road – while providing substantial coverage in the interim.

It’s important to have coverage when you need it, especially when the people you care about depend on you financially. If you can’t afford or don’t need a 30-year term – start with what you can afford and supplement when your circumstances change.

What’s the Difference Between 20 Year Term Life Insurance and 10, 15, or 30 Year Terms?

A policy with any term length will behave the same way — if it is level term life insurance. The only difference is the length of the term.

What does “level term” mean? Well, you know how premiums for health insurance and auto insurance seem to increase every year? Well, this doesn’t happen with 20 year term life insurance premiums!

Your premiums for this life insurance coverage will not change for the length of the term. What other kind of insurance coverage can offer no price increase for 20 years?

That’s one reason 20-year term life is one of the most popular policies we sell. Our clients love this product because it’s inexpensive considering the period of time it covers.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Advantages of 20 Year Term Life Insurance

A 20-year term life insurance policy has advantages and disadvantages. Let’s cover some of the main advantages:

The Timing

Think about your life 20 years from now. What do you see in store for yourself? Many clients buy 20 year term life insurance because they believe their children will be working adults when the policy expires.

You should also be in a better financial position after two decades of career progression. Hey, I hope that you use that additional salary to pay down your mortgage and debts too!

A 20-year term policy covers you while you’re most vulnerable: while you have kids at home or in college, a hefty mortgage, and not many financial assets.

Then, in 20 years, when these strains start to let up, your coverage will expire and you can reassess your coverage needs. By then you may need whole life insurance with a smaller payout.

The Price Tag

A 20 year term life insurance policy is cheaper than a 30-year term because you are insured for a shorter period of time. And, a 20-year term provides a better value than a 10-year term policy.

With 20-year term can either enjoy the lower premiums or use this buying power to maximize your amount of coverage.

The Peace of Mind for 20 Years

Although level term life insurance does not accrue cash value, it does provide peace of mind. For 20 years you’ll know if the unexpected happens your family could at least access your life insurance coverage to rebuild a new life.

You can’t put a price tag on that.

Of course, the extent of your peace of mind depends on the amount of coverage you buy. Always be sure you have enough coverage. I can’t stress how important this is. Depending on your debts and obligations your death benefit may not go as far as you would like.

The beauty of locking your premiums in for 20 years is that they won’t increase during that time. Let’s say you get cancer in year 10. Your premiums are guaranteed level for the rest of the term.

While 20 year term life insurance costs a bit more than 10 or 15 year term, it provides more comprehensive coverage if you have a young family.

If you don’t die during your term, you can still convert the policy to Guaranteed Universal Life, which is a permanent life insurance policy, without proof of insurability (that is if you follow my advice).

Read more: How Long Do You Have to Have Life Insurance Before You Die?

This is an important benefit.

BEWARE: Most term policies have this conversion option built in. Make sure yours has it. Every term policy we sell has a conversion option.

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

Disadvantages of 20 Year Term Life Insurance

There are also some disadvantages to 20 year term life insurance:

Premiums Will Increase When Your Policy Expires

With 20 year term, you’re buying a fixed, level premium for the duration you select. At the end of the 20 year period, your policy doesn’t simply cancel automatically. Instead, your premiums stop being level. They increase annually, usually by a lot.

So if you choose 20 years, at the end of the term, your rates will increase by as much as 5 – 10 times the low premiums you’d gotten used to for two decades.

The lion’s share of policies provide coverage to age 95; however, most people drop these policies after the initial 20 year term because they don’t want to pay the increased rate.

At this point, you may have the option to “convert” the policy to permanent coverage, which means you can continue your coverage without proving you’re healthy, but at a higher price.

It May Not be the Best Option for People In Very Poor Health

Twenty-year term life insurance isn’t a great option if you have a serious medical condition. Insurance companies base the amount of your premiums on your health rating.

In some cases, you’ll get rated more favorably if you purchase a permanent policy such as guaranteed universal life. If you’re in good health you’ll get great rates on term life.

Shopping for Life Insurance at the End of Your Term is Costly

If your 20 year term life insurance policy has matured and you want to reinsure yourself, chances are companies will provide you with an expensive quote. When you’re 45 years old, you may have some health issues that you didn’t at 25.

Health conditions make getting a new policy more complicated. This may mean your premium payments double due to your new health rating.

Should I Buy 20 Year Term Life Insurance?

The most common two questions I get are:

- How much life insurance do I need?

- What type of life insurance do I need?

…so I’ll share a real life example with you to give you some insight into the benefits of 20 year term life insurance:

20 Year Term Case Study

A married couple in their 30s recently asked me whether they should buy 20 year term life insurance or 30 year term.

Both of these policies could meet the couple’s insurance needs. They don’t have children yet, but they plan to down the road.

They inquired about a $500,000 policy for the wife and $1 million policy for the husband.

Their main concerns were:

- Cost: 30 year term is more expensive than 20 year term life insurance plan.

- Children: Although they don’t currently have kids, the wife indicated she wants a policy to cover their future children, should she and her husband die while they are minors.

Since they haven’t had their kids yet, they are worried that 20 years might not provide enough coverage.

This lady is ahead of the game and thinking about the responsibilities of having a dependent or two in ADVANCE. If she and her husband died in a tragic accident, she knows the kiddos will be taken care of.

Read more: Husband Died Without Life Insurance: What to Do

Is 20 Term Life Insurance the Best Type of Policy?

The answer is there isn’t a boilerplate generic answer.

This is yet another reason you should contact an independent life insurance agent today.

My answer depends on your PERSONAL circumstances.

If the couple in our example above is financially responsible, they pay down their debts and have their kids in the coming year – 20 year term life insurance may be perfect for them.

That being said, if they’re going to wait a while and don’t have a financial plan in place, the 30 year term insurance might be better suited.

You also have to weigh in your age and health. The health you enjoy in your 20s and 30s may be more complex in your 40s and 50s.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How to Get the BEST 20 Year Term Rates

Face it: We’re all looking to save a dime or two. Here are a few more tips to help you keep the cost of your premiums down:

- Use Our Pennies from Heaven Strategy: Learn how to save 10% – 30% on 20 year term life insurance rates by using our Pennies from Heaven Strategy today.

- Pay Semi-Annually or Annually: If you can afford to pay your premiums up front you’ll rake in 4% – 8% in additional savings!

- If you have a health issue, ask us about our “Special Case Roadshow”: If you have a tough medical condition like diabetes or history of a stroke or heart disease, chances are companies will rate you. When we get a tough case, we take it to over two dozen underwriters at different companies to see which one will give you the best rate. Call us at 888-603-2876 for details.

- Get a medical exam: The life insurance industry is changing on this, but for the cheapest rates you should still get a policy that requires a medical exam. A few carriers could give you great rates without the exam but most still depend on the exam to measure your life expectancy.

- Get the right coverage amount: Not everybody needs a million dollars in life insurance. Measure your insurance needs before choosing a coverage amount. The more coverage you buy, the higher your premium payments.

20 Year Term Life Insurance Quotes

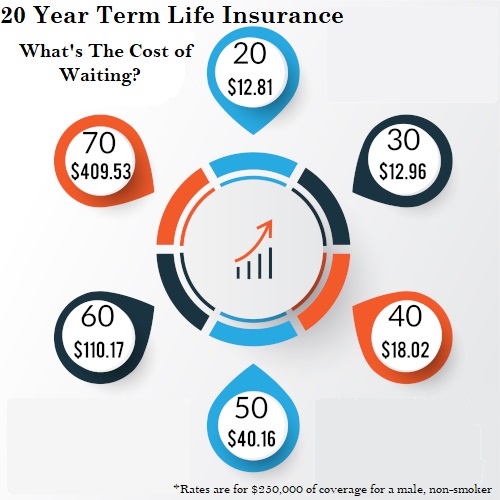

Here are some sample 20 year term rates with $100,000, $250,000, and $500,000 of coverage.

| Coverage Amount | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| 20 Year Old | $8.88 | $12.81 | $19.31 |

| 30 Year Old | $8.91 | $12.96 | $19.74 |

| 40 Year Old | $10.84 | $18.02 | $29.06 |

| 50 Year Old | $21.94 | $40.16 | $72.76 |

| 60 Year Old | $52.39 | $110.17 | $208.20 |

| 70 Year Old | $206.22 | $409.53 | $800.01 |

*Please note all quotes are based on a Monthly premium. Quotes are for a male, in excellent health, non-smoker. Rates are subject to change.*

We have access to dozens of the top life insurance companies and know the ins and outs of their underwriting guidelines.

Why is this important?? All life insurance companies basically offer the same products right? WRONG!

Nothing could be further from the truth. Some companies are far more lenient than others when it comes to pre-existing medical conditions.

We find the company that works for your UNIQUE circumstances.

A dip in your rating can mean you will pay thousands more over the course of your policy term.

Get a Free 20 Year Term Quote Today

The fact is, for most people, a simple 20-year term life policy from American National is the best place to start.

Runners, triathletes out there?

If fitness and personal health are an important part of your life, I recommend also checking out Health IQ.

Read more: Health IQ Life Insurance Review

All of us, especially those who have families, should go the extra mile to find information about the different types of insurance.

This is the best way to make sure that whatever plan you buy, it will give your loved ones the most secure future possible.

I can give you theoretical free quotes out the wazoo – but the truth is everyone’s application is different because everyone’s life is different. You need to have someone on your side who understands this VERY complex process.

…AND we are the very best.

I hope this article helps you navigate the pros and cons of 20 year term life insurance.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.