10 Best Ways to Save 50% (or More) On Life Insurance

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

How would you like to take a peek into my secret stash of tricks that I’ve personally used to save my clients 10% to 70% on life insurance?

Well you’re in luck.

… because today I’m going to show you 10 of my absolute BEST strategies, proven to save you thousands on life insurance.

As an added bonus you may want to check out my picks for best term life insurance companies HERE!

Warning! You aren’t going to see tips you already know like “ask for a referral” (yawn!) or “get more than one quote” (ZZZzzz).

I’m bringing the heat!

And in today’s post I’ll reveal the step-by-step process you can use to start saving today.

SAVE UP TO 73% ON LIFE INSURANCE!

Think saving money on life insurance is as easy as getting a quick online quote? Think again! You need an expert guide. We know the right companies for every age, health issue, and need.

It’s quick and easy! Get started with a free life insurance quote now!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

MY TOP 10 TIPS FOR MASSIVE LIFE INSURANCE SAVINGS

The Pennies from Heaven Strategy (10% – 30% Savings)

Most people are aware life insurance companies usually pay out a lump sum death benefit upon the death of the insured.

But did you know that some companies allow you to make a special election to have your policy pay out an income stream over a set period of years rather than as a lump sum?

We call this our Pennies from Heaven Strategy, and it regularly saves our clients 10% to 30%.

Read more:

For example:

A 45 year old man buying a $500,000 20 year term can save about $13,200 over the life of his policy, by having his beneficiaries receive $50,000 per year for 10 years instead of a $500,000 lump sum.

Who Should Use the “Income” Option?

There are multiple situations where a recurring income makes more sense than a giant lump sum death benefit.

- Income Replacement – The #1 reason our clients buy life insurance is to protect their spouse and family from the financial shock of losing the breadwinner’s income. So if you’re protecting “lost income”, it makes sense to replace that loss with an income stream… especially if you get a discount for it.

- Your Beneficiary Lacks Financial Wisdom – perhaps you’re married and don’t feel your spouse would manage a large sum of money well. It makes sense to leave them an income stream rather than a lump sum which they may quickly squander.

- Your Beneficiary Has Special Needs – If your spouse or child is incapacitated or has special disabilities, it may make sense to provide them with a long-term monthly or annual benefit, especially if a trust has been set up for that individual, since a trustee would need to manage the lump sum funds (and would probably charge for this.)

- You Want to Provide a Long-Term Predictable Benefit – Perhaps you support a charity or religious organization, and like the idea of continuing to do so long after you’re gone.

“Income Option” Case Study – Immediate Needs PLUS Recurring Income

Let’s take a 35 year old man who is married with 2 children.

He earns $4,000 per month and has a $125,000 mortgage.

Upon his unexpected passing, his wife and children would face immediate financial needs such as:

- Funeral and burial

- Probate expenses

- Credit card debt

Plus there would be recurring and future income needs for:

- Food and Utilities

- Childcare

- Healthcare

- Mortgage or Rental Payments

SIMPLE TWEAK MIXES IMMEDIATE INCOME WITH RECURRING INCOME

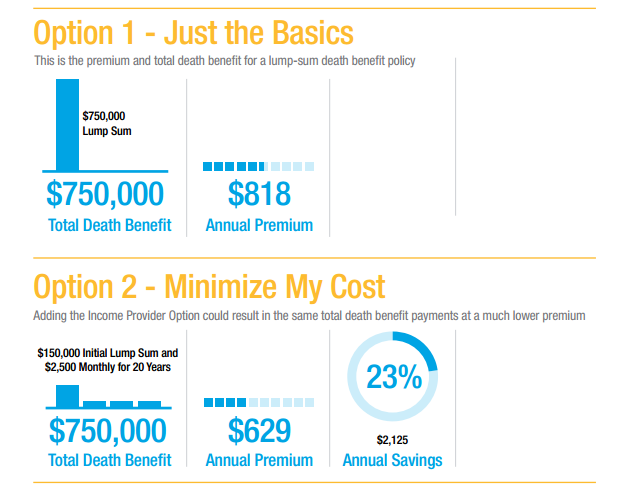

After speaking with an agent, he determines he needs $750,000 of coverage so his wife can pay some immediate expenses as well as have recurring income to help his family with future income needs.

A 20 year term policy (with a lump sum benefit) will cost him $818 per year.

… or he could use the income option to save $3,780 over the life of his policy.

By selecting a policy with a $150,000 immediate death benefit and monthly payment of $2,500 thereafter, his new premium will be $629 per year…

That’s a 23 % Savings!

Either way his wife and children receive $750,000.

PRO TIP: For even more savings, try extending the payout over a 20 or 30 year period. This can get you savings of up to 30%!

How to Buy a Policy with an Income Death Benefit

This is a very rare benefit, but if you find a company that offers it, you are almost guaranteed to save money over any other option out there.

Our quote forms on this site aren’t able to generate rates for policies with the income option yet, so I recommend first getting a traditional quote below, then call us at 888-603-2876 to start comparing a traditional payout vs. an income stream payout.

Layer or Stagger Your Term Maturities (10%-30% Savings)

Let’s say you’re looking to purchase a 20 or 30 year term life insurance policy.

… do you think your coverage needs will be the same in 10 to 15 years as they are today?

If you’re prudently investing for the future and paying down debts, you probably WON’T NEED as much coverage halfway through your policy as you do today.

So why pay full price for a long term?

Instead, you should consider purchasing 2 policies that will cover both your short term and long term needs.

How to Save on Long Term Policies (20-30 Years)

Let’s assume you’re a hard-working individual, diligently putting money away for the future, but need $1 million of coverage today for income replacement. You plan to work another 30 years.

Most agents would sell you a 30 year term policy for $1 million dollars in this situation.

Do this instead:

You might consider buying 2 policies to cover your changing needs:

- one with a short term

- and one with a long term

For example:

You could buy two $500,000 policies, one with a 15 year level term and one with a 30 year term.

Read more: 7 Simple Steps to Changing Homeowners Insurance Companies

SAMPLE CASE:

40 Year Old Male in Preferred Health

He has a need for $1 million of coverage today with a declining need for coverage over the next 30 years.

ONE POLICY – 30 Year Term, $1,000,000 Death Benefit

- Cost: $1,183 per year

TWO POLICIES: 30 Year Term with a $500,000 Death Benefit and a 15 Year Term with a $500,000 Death Benefit

- 30 Year Term Cost: $618 per year

- 15 Year Term Cost: $237 per year

TWO POLICY TOTAL: $855 ANNUALLY

In this example, we must understand that the total amount of coverage begins at $1 million for either case, but in the second case, $500,000 falls off after the first 15 years, leaving only $500,000 of coverage for years 16-30.

Use an Experienced “Independent” Agent (10%-70% Savings)

Do you know the difference between an independent and a captive agent?

… Anywhere from 10% to 70%. 🙂

And NO, that’s not a typo!

A good independent agent can easily save you over 50% on life insurance.

Let’s discuss the difference between the two and how independent agents save you money.

Captive vs. Independent Agents: The Choice Is Obvious

Captive Agents only represent one company.

So if you go to a State Farm agent for life insurance, guess what company you’re probably going to end up buying from… State Farm.

Independent Agents represent multiple companies.

They can shop your case around to multiple companies to see which company has the lowest price.

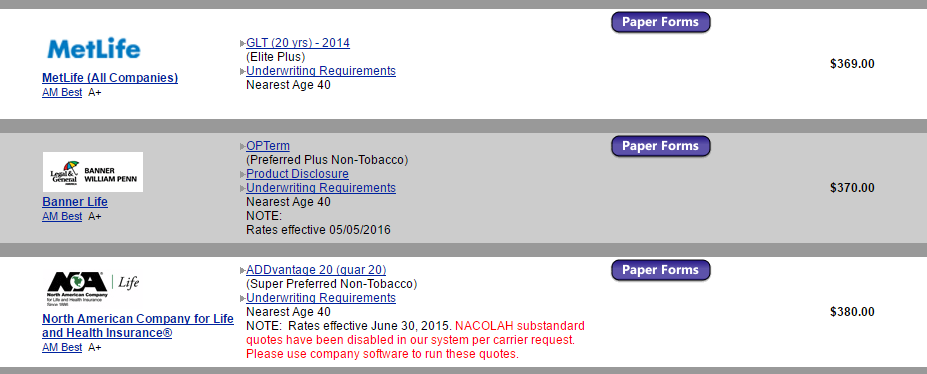

You can tell if you’re at an independent agent’s website if you request a quote and get MULTIPLE results like this:

The Magic is in the HEALTH RATING

Perhaps you’ve heard that life insurance companies “classify” you based on risk.

… and the better your health rating, the lower premium you’ll pay.

Most companies have 4 “rate classes” or “health classes” named:

- Preferred Plus (PP)

- Preferred (Costs 25% more than PP)

- Standard Plus (50% more than PP)

- Standard (75% more than PP)

(Beyond Standard, most companies have multiple “sub-standard” classes, each 25% more expensive, typically called Table A through H, or 1 through 8)

An independent agent’s job isn’t just to run your DOB and amount you want and send you the top quote.

Oh, if only our job were so easy. 🙂

The agent’s job is to help you find the company that will charge you the least for your unique personal history or health.

For example, say you have a history of any of the following common personal or medical situations:

COMMON AILMENTS THAT CAUSE HIGHER RATES

- Diabetes Type I or II

- Heart Disease

- Sleep Apnea

- Overweight

- High Blood Pressure or Cholesterol

- History of Cancer

- Elevated Liver or Kidney Numbers

- Anxiety/Depression

- Epilepsy

- Stroke or TIA

COMMON PERSONAL HISTORY PENALTIES

- Tobacco Use

- Family History of Cancer, Heart Disease, or Diabetes

- Hazardous Occupation

- Pilot’s License

- Scuba Diving

- Driving History (Multiple Tickets or DUI’s)

- Drug or Alcohol Abuse

- Criminal History

- Travel Plans

- Citizenship

What’s important to recognize is that every life insurance company treats the above listed personal and health concerns differently.

Some are very stringent when it comes to family history, for example.

…Others are not.

Some allow you to smoke cigars or pipes and won’t charge you tobacco rates.

…Others will charge you the same rates as cigarette users.

Costing You: 200 % More!

A knowledgeable independent agent knows which company is best for all of the situations above.

The Great Mistake

Having said that, if you go to a captive agent with any of the above mentioned health or personal history concerns, you are at the mercy of how that particular company underwrites your unique situation.

…And chances are, there’s another company out there who will be much more lenient, charging you far less for the same amount of coverage.

I’ll be the first to admit that when I started selling life insurance over 11 years ago, I made more rookie mistakes than most.

It’s not that I didn’t mean well.

I just didn’t know how to quote anyone.

As long as they seemed reasonably healthy to me, I quoted them the best rate. 🙂 (Insert slap to forehead sound)

Blood Pressure Example – How a Rookie Could Cost You $1,980

Say you’re a 40 year old male. You need a typical amount, a 20 year term policy for $500,000.

You’re in excellent health but you take blood pressure medication.

So you take your case to “Joe Rookie.” Joe runs the numbers assuming you’ll qualify for the best rate, Preferred Plus, and he pulls up the following quotes:

Your Rookie agent sees the top 2 rates are from MetLife and Banner Life.

Both are reputable companies. They’re about the same price, but MetLife is a bit better known and a dollar cheaper per year. So he recommends you apply with MetLife.

…and of course you have no idea this mistake just cost you $1,980!

Here’s the problem:

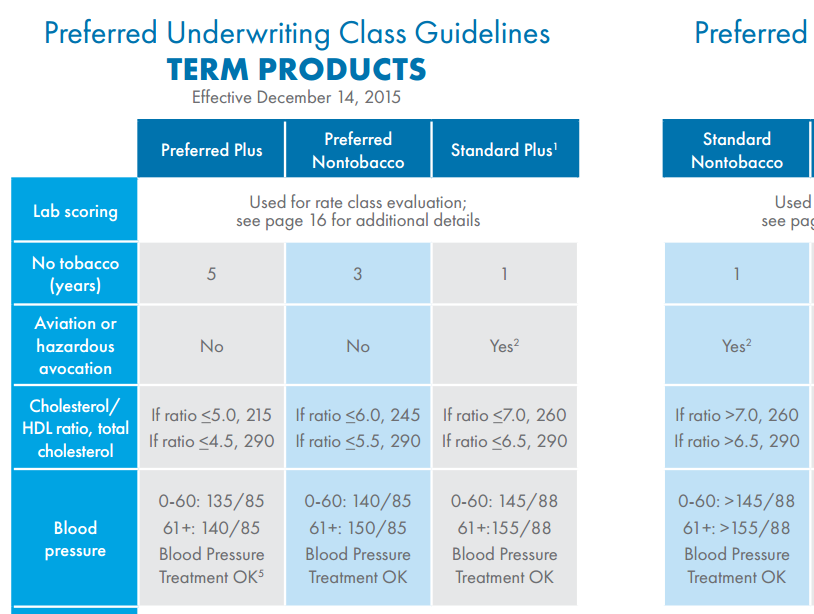

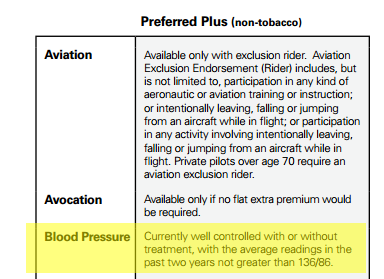

MetLife doesn’t allow you to take blood pressure medication and qualify for their best class, which they call “Elite Plus”. Here is their published underwriting guideline on blood pressure.

But it gets worse…

MetLife doesn’t allow you to qualify for their 2nd best health class “Elite” if you take hypertension medication either.

So if you applied to MetLife, you’d end up qualifying for their 3rd best class and you would pay $469 per year.

Banner Life insurance, on the other hand, DOES allow blood pressure treatment in their best class.

So if you had just applied to Banner, even though it looked like it cost $1 more, you would have actually qualified for their Preferred Plus rating and ended up paying just $370 per year.

That’s a 25 % Savings!

Or put in another way, $99 more per year multiplied by 20 years costs you an additional $1,980.

…and Rookie agents abound, folks.

Be sure you speak with a knowledgeable one who has access to multiple carriers.

HEALTH ISSUES? WE’LL HELP GET YOU APPROVED!

At Huntley Wealth, we specialize in helping individuals with high risk medical issues. You name it, and we’ve seen it. We’ll help you get approved quickly at a rate you can afford. Get started with a free life insurance quote now!

Bundle Insurance Policies (10%-15% Savings)

A few years ago, my wife and I were sitting down with our home and auto agent from Farmer’s Insurance to review our coverage.

While we were there, she asked if we would like quotes on life insurance.

Sitting up a bit higher in my chair and puffing my chest up, I politely declined, reminding her I was an agent and that we “had that all taken care of.” 🙂

But then she surprised me…

She said, “You know, Farmer’s offers a multi-policy discount once you hit 3 policies. You already have home and auto with me. Let’s see how much the discount would be if you added a life insurance policy.”

“FREE” Life Insurance

That was interesting, I thought.

A few clicks later, she informed me we could add a $50,000 policy on my wife, and the discount we would receive on the home/auto side would entirely wipe out the new life insurance premium.

…Or as my wife likes to say, it was FREE!

I’m not a Farmer’s agent and don’t have access to multi-policy discounts, so you’ll have to check with your home and auto agent for any bundle discounts.

I don’t recommend most home/auto carriers for life insurance, especially if you’re spending more than $10-$20 bucks per month, as they are typically way overpriced and terribly stringent if you have any health conditions, but if you’re healthy and just looking for a bit of extra coverage, this bundling hack is just too good to keep a secret.

Lose 3 to 5 Pounds – Save 25%-50% on Life Insurance

Here’s the deal:

Only 10%-20% of people who apply for life insurance qualify for the best rate.

That means the rest of us will likely fall into the 2nd best rating (Preferred) or lower.

Remember there’s a 25% price difference between each class.

…and few people realize the actual health guidelines for each class are typically separated by just a few pounds, or a few blood pressure points.

In other words, small health changes can have a massive impact on your premium.

Supercharge Life Insurance Exam Results in 1-2 Weeks (Save $6,000)

My goal in this section is to convince you to take dietary and fitness actions prior to taking your life insurance exam.

Just notice how small of a gap there is between American General’s maximum blood pressure levels for each of their health classifications:

In case that’s difficult for you to read, here are the max blood pressures they’ll allow for their top 4 classes:

- 135/85 – Best Class

- 140/85 – 2nd best class

- 145/88 – 3rd best class

- 145/88 – 4th best class

So let’s say today your blood pressure is 142/83…

You can’t qualify for their 1st or 2nd best rate class. You’ll get their 3rd best class.

…which costs 50% more than their best class.

Let’s put that into perspective.

If you buy a 30 year term policy and pay $50 per month at Preferred Plus, that means you would pay $75 per month at the 3rd best rating… a difference of $6,000 over the life of your policy.

So if I were to write you a $6,000 check today, would that be enough for you to work on your health a bit before your exam?

I hope so!

How To Quickly & Easily Improve Your Key Lab Levels

The good news?

You can quickly make positive health gains before a life insurance exam.

A life insurance exam tests some of the following:

- Weight

- Blood pressure

- Cholesterol

- Sugar levels

- Liver & kidney functions

And the great news is that you can improve all of these with the following prescription:

- Eat Sensibly – Reduce your carbohydrate intake (white bread, rice and pasta) and bad fats from fast food and fried foods.

- Drink Lots of Water

- Get Plenty of Sleep

- Exercise – You’ll be amazed how quickly your body can rebound. If you currently don’t exercise, even if you just work out 3-5 times before your exam, it will have an impact on your results.

Try this for 1-2 weeks and you’ll likely lose a few pounds or more, feel better, feel less stressed, and reduce some of your lab levels.

Of course, we should emphasize that we’re not food or diet experts here at Huntley Wealth, and always talk to your doctor before starting a new diet or exercise routine.

In Conclusion: The long-term savings you’ll receive from eating right and exercising for just 1-2 weeks before your exam are staggering. Do it!

Buy MORE Coverage – 10%-25% Savings on “Cost Per Thousand”

Yeah, that’s right. It’s time to celebrate. 🙂

In this section, I’m going to reveal two more ways you can save money on life insurance that most agents won’t ever bother to tell you.

(or even know about)

First, I’ll teach you how you can actually buy MORE coverage for less money due to a pricing feature known as “banding.”

Next, I’ll show you how one of my clients doubled her coverage for just $4 more per month!

Banding Discounts – So Fun It Should Be Illegal

I love saving my clients money when they have a tough health issue and we’re able to find them the right company for the job, or we use our lesser-known income death benefit hack from tip #1.

But you know what’s even more fun?

Getting my clients MORE death benefit for LESS money.

…happens all the time.

Simply put, life insurance companies give “cost per thousand” discounts at certain levels or “bands.”

For example, many of them charge a little less per thousand when you hit:

- $250,000

- $500,000

- or $1 million

Therefore, if you’re ever looking at a policy for less coverage (but anywhere close to those amounts), ask you agent for a quote at the higher band.

Oh Yeah!! FREE Life Insurance! If You Want to Shout “God Bless America” Right Now, We Won’t Judge You. 🙂

MORE COVERAGE FOR LESS PREMIUM

(All pricing examples taken from a 35 year old preferred health male, 20 year term. The bands work for any age, though.)

Prudential Life Insurance Pricing:

- $200,000 Face Value: $269 Per Year

- $250,000 Face Value: $238 Per Year 🙂

Protective Life Insurance Pricing:

- $450,000 Face Value: $293 Per Year

- $500,000 Face Value: $251 Per Year 🙂

Protective Life Insurance Pricing:

- $900,000 Face Value: $452 Per Year

- $1,000,000 Face Value: $426 Per Year 🙂

GET YOUR INSTANT QUOTE NOW!

At Huntley Wealth, we don’t just write about savings tips online. We practice it every day. We’re experts at finding affordable coverage, especially if you have a health condition.

So if you need life insurance or are paying too much, we’d sincerely love to help. Call us now at 888-603-2876 or click below to get started.

Double Your Life Insurance Coverage for 30% More Premium

I mentioned a client of mine was recently able to double her coverage for $4 extra per month.

In her case, she was looking at a $250,000 policy for just $11 per month.

For $15 bucks, she could double it to $500,000.

How is this possible?

Policy Fees.

Insurance companies add fees of $60 to $80 on all policies, regardless of their size.

So many people don’t realize when they see a $10 to $20 monthly premium, that 25% of that premium may be going to the policy fee instead of to cost of insurance.

In my client’s case, the breakdown of her policy fee + cost of insurance at $250,000 was $7 for the policy fee and $4 for the cost of insurance. This is how she was able to add an additional $250,000 for just another $4.

Why is this important?

If you have a smaller premium, such as $10 to $20 per month, you can add on a lot of coverage for very little extra premium.

The Special Case Roadshow – 25% – 50% Savings

Just about every client we come in contact with has some sort of health history or personal situation that requires special attention.

…and no two cases are alike.

So while you may have learned what we, as independent agents already know – which companies to send your blood pressure or cholesterol cases to – it gets tricky when you start combining health issues.

For example:

Which company will give us the best deal on a client who has diabetes, takes depression medication, and has sleep apnea?

Answer: We take all our tough cases on Huntley Wealth’s exclusive “Special Case Roadshow” searching for the best deal!

What is the Special Case Roadshow?

Perhaps you have diabetes, sleep apnea, or depression, like our example.

… or maybe you travel outside the U.S.

…or maybe you have a rare health condition no agent seems to understand.

The point is, as agents, we are constantly faced with new cases we’ve never seen.

Instead of guessing which company will give you the best health class (Remember – best health class = lowest premium), the best thing to do is inundate a multiple of insurance companies with email and calls, describing the client’s unique situation, and ask each company how they would tentatively rate our client.

At Huntley Wealth, we call this the Special Case Roadshow.

Essentially we take our client’s case out to anyone who will have a look — and then compare all their responses.

The goal is to see which company will make the best “tentative offer” or “quick quote.” This is our way of finding out who will be most lenient in regard to a particular case – and get them to “put it into writing.”

Then we apply to the company and attach their written tentative offer with the application. 80% of the time, they stick to the original offer.

(Again these are not firm offers – they are based on the limited knowledge the insurance company receives, so sometimes when the company obtains exam results and medical records, they find out the issues are much worse or much better than what was originally written to them, and they change their offer – something they have every right to do.)

3 Steps to the Special Case Roadshow

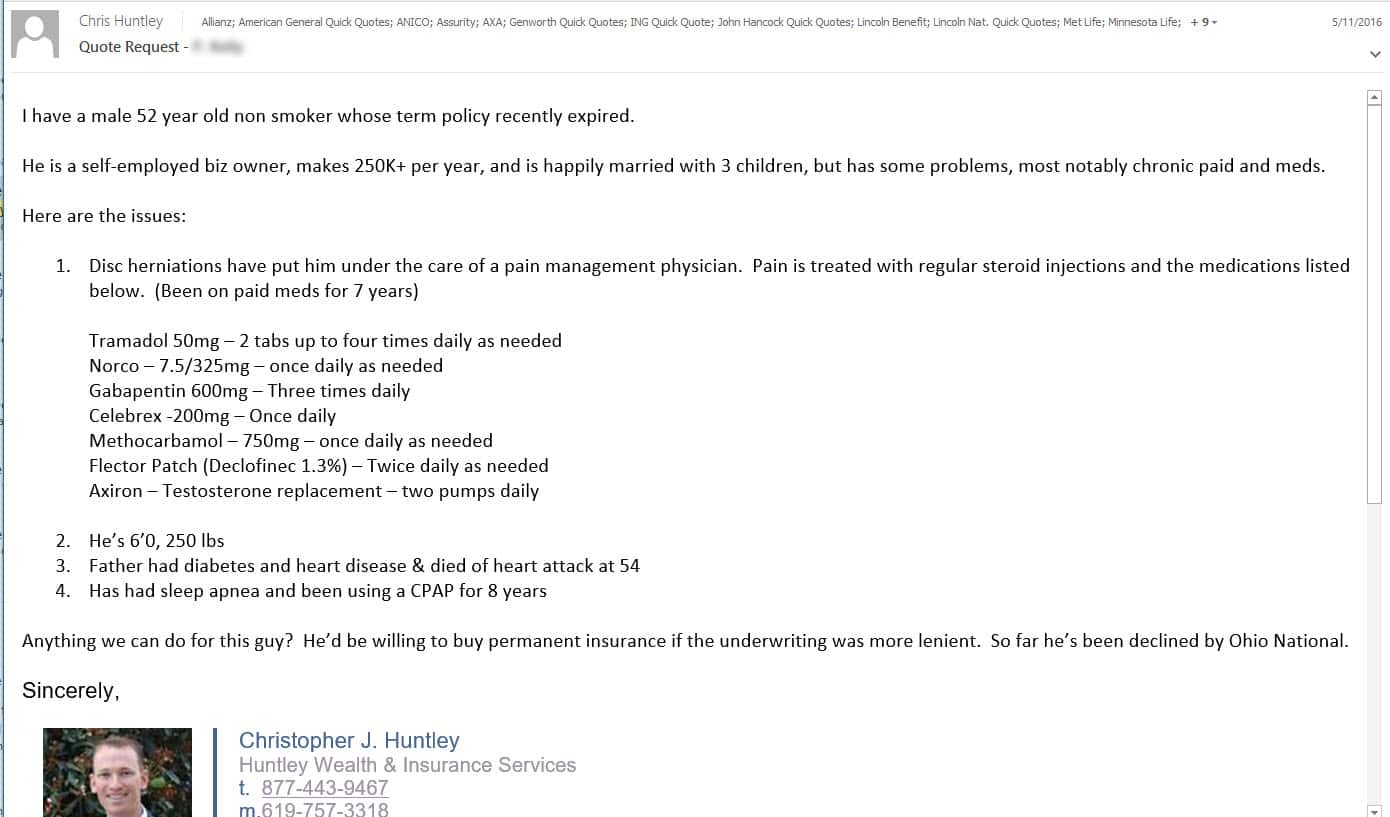

STEP 1 – Compose and Send Out Your Email

(If you’re doing this on your own, you want to go to multiple insurance company sites and look up contacts in their “underwriting department”. If you’re using an agent, encourage them to do this for you.)

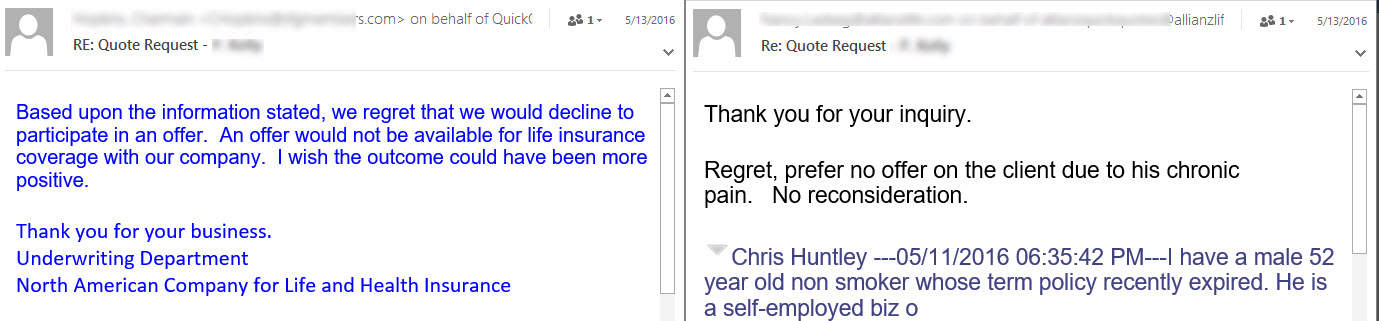

Here’s an example of one I sent out recently that went VERY well:

As you can see, I listed ALL the negatives about this client. His primary issues were:

- Chronic Pain and Medications

- Overweight

- Sleep Apnea

STEP 2 – Organize Your Responses

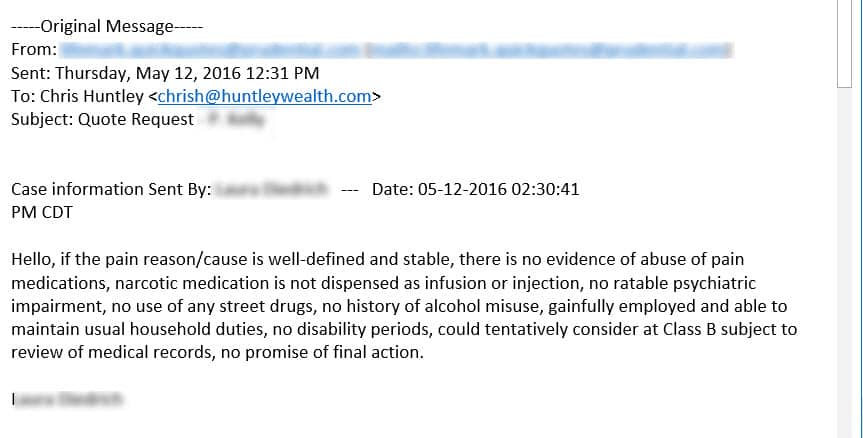

You’ll Get a Huge Range of Offers

At this point, the range of offers that come back are generally very wide. Often we’ll receive several “Sorry, we cannot offer” messages back, but then a few other companies will surprise us and make an offer.

In other cases, one offer from a company might be exceedingly better than any others, so we go with them.

Here were a couple of the responses to the case above:

STEP 3 – Run the Quotes and Apply to the Company with the Lowest Rate

99% of the time, you’ll want to apply to the company who offered the best health class.

Occasionally, one companies “Standard” rate will actually be cheaper than another’s “Standard Plus” rate, but it’s rare. Just run the quotes to be sure, and then apply to the one with the lowest rate.

In the case above, this was the winning response from Prudential, one of our favorite companies.

The best part?

We received multiple decline letters for the case above, but Prudential came through with a Standard offer, even better than the Table B substandard trial offer response.

Our client was thrilled.

If you think you might be overpaying for life insurance or have any variety of health or personal conditions, please call us at 888-603-2876 or start a quote below. Tell your agent you need The Special Case Roadshow.

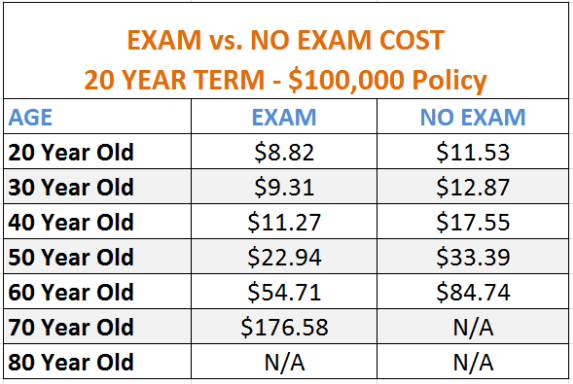

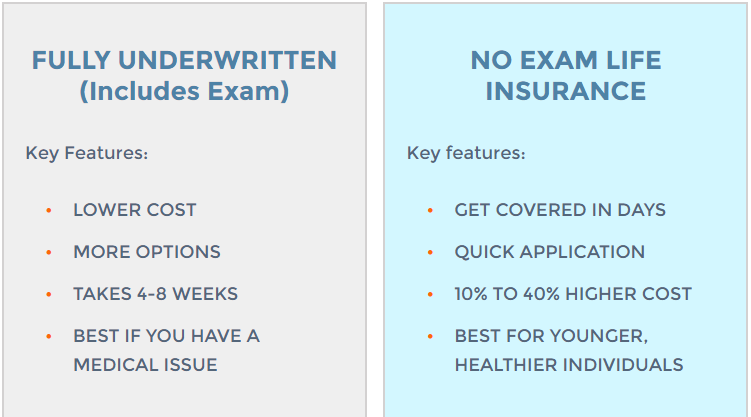

Take a Medical Exam – 10%-50% Savings

Don’t get bamboozled into a “no exam” life insurance policy.

They’re rarely the right option.

And they cost on average 10% to 40% more.

In this section, I’ll reveal why you should take a medical exam when you buy life insurance.

…and why life insurance agents don’t want you to!

The Case for “Fully Underwritten” Policies (WITH Exams)

Just think of it from the insurance company’s perspective.

The more they know about you, the less risky you are.

…and the less risky you are, the LESS they need to charge you.

Simple.

Some insurance agents will try to tell you to go with a “no exam” policy because “who knows what they’ll find if you take a medical exam,” but in general, that’s just a line they use to get you to buy the type of insurance THEY want you to buy instead of the type you NEED!

As you can see, it costs about 30% more:

*Prices above are monthly estimates as of 3/1/18 for a male in preferred health. Premiums are not to be construed as an offer for insurance. Individuals must qualify. Prices subject to change.

Look:

There are only a few good reasons to buy no exam life insurance, ever.

- You’re deathly afraid of needles (or have white coat syndrome)

- You need coverage in place immediately and don’t care about the extra cost

- You want to be extra cautious about getting coverage. You don’t want to be surprised by something that comes up in your medical exam.

For example, if you suspect something just isn’t “quite right” with your health, but you haven’t seen a doctor yet about it. Be careful here.

Do not wait to see a doctor about any health condition. You’re risking your life if you do.

However, some people have successfully purchased no exam policies when feeling something is “off” and were able to qualify, later finding out they had cancer or some other terminal illness.

So it is a way to sidestep the exam. Again I don’t recommend this, but I’ve seen this done.

Here’s the breakdown:

Benefits of No Exam

Don’t get me wrong. There are some benefits to life insurance with no medical exam, such as:

- faster approval times

- short and simple application

- removes the exam roadblock

- can help you be declined unnecessarily

The Problem – Greed & Speed

The problem is when agents sell it out of greed. Everyone understands insurance agents need to make a living.

One of the best ways an agent can make:

- more money

- and faster money

… is to sell no exam policies.

GREED

Agents get paid based on how much premium you spend. So naturally, some of them will want to sell no exam policies only for this reason.

You paying more = More $$$ for the agent

SPEED

Most of the agents you’ll speak to (if you’re looking for quotes online) are jammed up on the phones all day long. They’re trying to make their 5 sales per day quota, and traditional sales (with exams) simply take longer.

So one easy way to make quicker sales is to sell no exam policies.

Next, whereas traditional policies sometimes take several weeks for approval and “in force” status – (that’s when the agent finally gets paid) – an agent can get an approval on a no exam policy within a few days and get paid right away.

Interrogate Your Agent – 10% – 70% Savings

Now that you’ve learned some of what agents do to save you money, you probably realize that you want to use an independent agent.

But how can you tell if you have an experienced one, and if they know how to implement the secrets in this guide?

Well, besides the obvious choice that you should be using Huntley Wealth for all your life insurance needs, here’s what you can do if you’re vetting a friend or relative to see if they can do the job.

Interrogate them! 🙂

OK…so maybe “interrogate” is a bit of a strong word.

But seriously, you can’t risk getting a “rookie” agent. As we discussed earlier, it could cost you 50% or more.

If your agent can answer the following questions, you should be OK.

Here are some questions you should ask:

#1 – What’s your Insurance license number?

Look them up on your state’s department of insurance website to make sure they are licensed and they don’t have any complaints pending. You can also see how long they’ve been in business and how many companies they represent.

#2 – Are you independent? How many companies do you represent?

Again, you’re looking for an independent agent.

#3 – Are you quoting me the absolute lowest rate you have? Can you send me a screenshot of your quote results?

Many independent agents won’t give you the lowest rate they have if they don’t think you are shopping around. So put them to the test. If your quote isn’t the lowest on their results, ask them why they’re recommending that company.

A good answer will have something to do with company rating or more lenient underwriting guidelines. But you don’t want to end up paying more because an agent is pushing a particular company so they can win an “incentive trip” or sales competition.

#4 – Can you show me the insurance company’s underwriting guidelines where it says I can qualify for “preferred” or whatever they’re quoting you with your particular health issue?

Don’t skip this. I recently spoke to a guy who had been quoted best class by Northwestern Mutual and had just gotten out of rehab for alcohol abuse 12 months earlier. He’s a decline everywhere, and yet he got quoted best class.

Any agent should be able to show you the underwriting guide describing their company’s stance on all common health concerns, like this for blood pressure:

#5 – Do you have any client testimonials you can share with me?

A good agent should be able to share dozens and dozens.

16 More Bonus Tips – 8%-40% Savings

I hope you’ve enjoyed our savings on life insurance guide.

Our first 5 tips were mostly “lesser-known” tips, in my opinion.

I wanted to bring you something more valuable than “get multiple quotes” (yawn) or “be sure to ask for a referral” (ZZZzzz).

… My goal here is to bring you the insider goods.

Please let me know in the comments below which of these tips you’ll be implementing, or if you have any questions.

#6 – Pay Annually

Most companies offer a 8% to 9% discount if you pay annually.

You can save a little more, by paying quarterly or semi-annually instead of monthly

#7 – Buy a “Second-to-Die” Policy (for Estate Planning)

A second-to-die policy insures two individuals (typically married), and only pays out when the second one passes away.

Since both individuals have to die, the premiums are typically 10% to 20% lower for this type of policy than if you were to buy the exact same policy on the healthier individual.

#8 – Backdate Your Policy or Use an “Actual Age” Company

Most life insurance companies determine your age using “nearest age”. For example, if you’re 56 years old and your birthday is in 3 or 4 months and you apply for life Insurance today, you will already be 57 years old as far as their pricing goes.

One way around this is if you’re within 6 months of your next birthday, use a company that uses your “actual age” rather than nearest age. Prudential is one of them. Again, this is another peril of working with a captive agent. Sometimes being a year older can have a 5% to 12% affect on your premium depending on your age.

The other thing all the nearest age companies do is allow you to backdate your policy up to 6 months. This way you can lock in a rate as your younger age.

But be aware you’ll have to pay from the effective date. So if you are paying monthly and backdate 3 months, for example, you would owe 3 months of premiums to make your policy effective. It’s typically worth it, though, since paying a few months of back premiums is better than paying 5% to 12% more for 10, 20, or 30 years.

More detail and examples can be found here.

#9 – Annual Renewable Term (ART)

If you need insurance for a very short period of time, try buying a 1 year term or annual renewable term. Transamerica has one. It’s even cheaper than 10 year term.

#10 – Buy Term – Invest the Rest

About 2/3 of all policies sold today are permanent insurance (mostly whole life). One of the sales tactics agents use to get you to spend more money is convincing people to “invest” in whole life insurance.

Agents will tell you that you’ll get a reasonable rate of return, guaranteed interest, tax deferred growth, and tax free access to your money.

It sounds really good, but it’s a terrible investment.

One of the reasons is the up front commission or “load” that is charged. Did you know that agents typically make 50% to 100% of the first year’s premium you pay for whole life? And there’s no such thing as a “no load whole life insurance” plan.

Some articles will try to tell you you can buy “low load” policies or there are “no load term policies” out there, but in reality, even if you call the company directly (bypassing the agent) the price is the same, so it doesn’t save you to search for no load policies.

Besides the hefty commissions and fees built into whole life, the tax benefits are overstated, the return is low (Dave Ramsey says to expect 2.6% total return over the lifetime of a policy), and they are grossly overpriced. 39% of people who buy whole life let them lapse during the first 10 years.

I also have this calculator which helps you compare buying term and investing the difference vs. buying whole life. Term almost always wins.

#11 – The 130/20 Mortgage Insurance Method

When you take out a loan to buy a house or refinance your mortgage, you’ll get bombarded with “mortgage life insurance” offers.

These plans pay your balance off so your family can be free and clear of a mortgage if you pass away. Since your mortgage decreases over time, they’re typically offering a form of decreasing term life insurance.

You can almost always get much better rates by purchasing a 30 year term life insurance policy from just about any independent agent.

Or you might find this strategy even better:

Buy a 20 year term life insurance policy through Protective for about 130% of the balance of your mortgage or your current 30 year term policy.

You’ll get a lot more coverage for 20 years, but since it’s a 20 year term instead of 30, your premium will still be lower than the “mortgage insurance” offers and probably even lower than the 30 year level term policies other agents are quoting you for the current amount of the balance.

This strategy, which we call The 130/20 Mortgage Insurance Method, typically saves our clients 20% or more.

How it works:

Protective’s policy is unique in that after the 20 year level term expires, your premiums don’t increase.

Instead the face value decreases. So if you still need mortgage protection for years 21 to 30, you can keep your policy, and the death benefit will still typically take care of any balance left on your mortgage.

#12 – Ask for Help from Family

OK, so this is more of an affordability tip than a savings tip…

Oftentimes, buying life insurance can be a great investment for the whole family, but you simply don’t have the money. You might ask your children to chip in if they are to benefit by the policy. It’s an easy sell, really.

“Son, when I pass away, we don’t have much for your mother to live on, so you’ll need to plan to take care of her.

OR, if you want, I’m buying this policy for a couple hundred bucks per month that I can’t quite afford. If you want to chip in half, your mother will receive the benefit and she won’t be a financial burden on you.”

#13 – Group Insurance (for Severe Medical Conditions)

While independent agents can get people insured for almost anything (even organ transplants, cancer, strokes, or heart disease), for those super high risk cases we have to use a “guaranteed issue” policy that is still a great deal if you have those issues, but it’s not as good as what you can get if you work for a company with a group policy.

Oftentimes these group policies will issue you life insurance with very simplified underwriting. Many of them only ask your gender and smoking status and base their pricing on those two questions.

In many cases, you can get between 1-6 times your annual income.

If you have a severe medical condition, you should definitely look at group policies through work. They could save you a fortune. Literally 500% or more, since guaranteed issue policies are quite pricey.

#14 – Don’t Wait to Buy

Life insurance premiums go up about 5% for every year you wait in your 30’s and 40’s, 6% to 7% in your 50’s, 8% to 10% in your 60’s and 11% or more per year in your 70’s.

Generally speaking, it will typically NEVER be cheaper to buy life insurance for you than it is today.

Also keep in mind that as we age, we don’t tend to get healthier. We tend to get less healthy.

So the cost of waiting could not only be the cost of waiting a year, but also the cost of being rated at a higher health class if you develop a medical condition.

#15 – Wait to Buy (Savings Tip for Seniors)

Did you really think, in an article where you learned how to buy more coverage for less money, that I wouldn’t have one other crazy trick up my sleeve?

Did you know that some companies have different health guidelines for people who are over age 60, 65, or 70? And they are WAY more lenient!

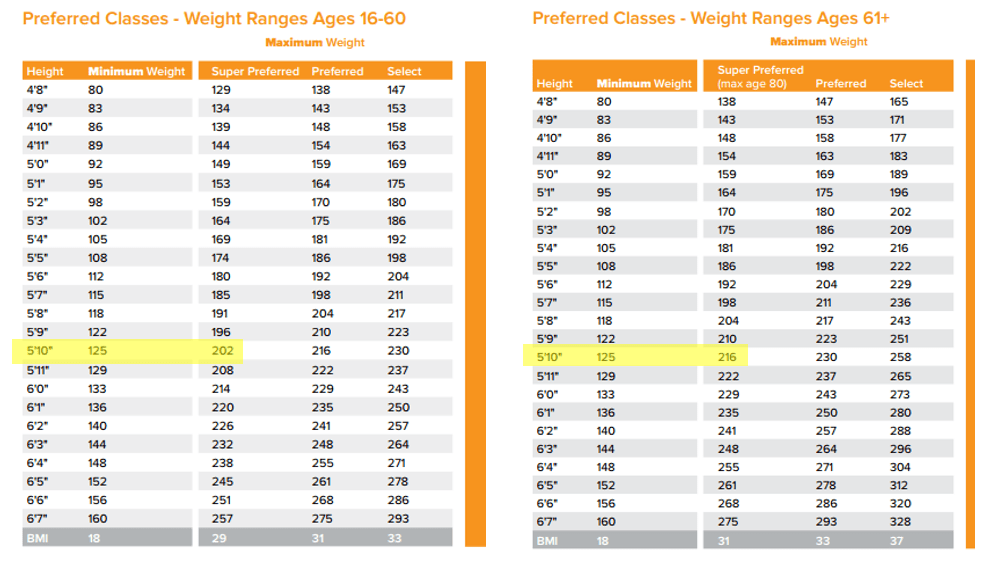

For example, the following charts show Voya Life Insurance‘s build charts. They have two, one for ages 16 to 60 and another for ages 61+.

Notice how much more you can weigh to get their Super Preferred rating if you are over age 61.

So let’s say you’re 5’10”, 60 years old and weigh 210 lbs…

(Today) you wouldn’t be able to qualify for Voya’s best rating.

Their max weight at age 60 is 202.

… But if you waited a year and maintained the same weight, you would qualify for their best rating since the new max is 216 lbs at age 61.

And the same is true for all sorts of companies and all sorts of medical conditions.

In conclusion, I never really suggest you wait to buy life insurance. You should buy what you need now if you’re on one of the cut-off ages and can’t qualify for best class, but then check back with your agent each year for more savings.

#16. Don’t buy from Alex Trebek if You’re Healthy

As a long-time spokesperson for Colonial Penn Life Insurance, Alex Trebek has been telling us about how seniors between the ages of 50 to 85 can get affordable life insurance with “no medical exam and no health questions” for as little as $9.95 per unit. (per thousand)

The problem, of course, is that with no medical questions or exam, this is guaranteed acceptance life insurance.

… In other words, if you can fog a mirror, you probably qualify.

Now, if you’re a healthy individual age 50 to 85, do you think you should be paying the same rate as someone with terminal cancer? That’s what happens if you buy a Colonial Penn’s guaranteed acceptance plan.

It’s a fine plan if you’ve got major health issues, but don’t buy it without first calling us at 888-603-2876 to see if you qualify for a traditionally underwritten policy.

(And while we’re at it, I won’t make this savings tip 21, but don’t waste your time joining AARP to buy cheap life insurance. It’s not going to save you in the end.)

#17. Apply for a Health Class Reconsideration

Have you dropped some weight, quit smoking, or perhaps had a health condition clear up since you first purchased your life insurance policy?

You can save money too!

You can either:

- apply for a new policy and hope for a better health rating (and lower rate)

- or apply for a “re-classification” with your existing carrier

Most companies allow you a one-time re-classification request. Just call your agent or your company and tell them your health has improved, and you’d like to apply to be re-rated. You may need to take a new medical exam, but usually it’s a simple application form and they’ll pull your medical records to verify.

#18. Free Insurance through Mass Mutual’s Life Bridge Program

Mass Mutual offers a program to individuals between the ages of 19 to 42 with a household income of $10,000 to $40,000 where they provide free 10 year term policies for $50,000, issued and paid for by Mass Mutual.

Mass Mutual has issued more than 13,600 of these policies since 2002 with close to a billion in death benefits.

#19. Reduce Your Coverage

Did you know that most companies allow a one-time reduction in coverage?

This could be welcome news for someone struggling to pay their premium, but doesn’t want to give up their policy.

Or say you’ve owned a policy for 15 years, and you no longer have a need for as much coverage as when you purchased it.

In either case above, call your agent or your company and ask for a reduction in death benefit.

Keep in mind, however, that many policies have a “minimum coverage amount” that you can’t go below… typically $50,000 to $100,000.

For example, if you have a $500,000 policy and want to move down to $250,000, that shouldn’t be a problem with most companies, but if you try to move it down to $25,000, that probably won’t work with most policies.

#20. Can’t Afford Your Premiums? Finance Them! (Non-Recourse Style)

If even tip #23 (reducing your coverage) can’t help you to afford your premium, you might look at a private equity firm, All Financial Group, who could potentially take over your existing policy and pay the premiums for you.

Here’s how All Financial Group can possibly help you:

- they lend you the money to pay the premiums for 5 to 7 years

- if you die while you still own the policy, your policy pays off the loan and the balance goes to your beneficiaries

- if your loan term ends and you’re still alive, you can pay off the loan and continue owning your policy, or can give the policy to All Financial Group and your loan balance will be forgiven

All Financial Group is looking for face values of anywhere from $100,000 to $20 Million and preferably people who have a life expectancy of 20 years or less.

#21 – Work with Huntley Wealth

OK, this one is probably the biggest no-brainer of all the tips here.

Don’t let a rookie sell you life insurance because they’re your brother or in your church group. You need the pros.

… and we can save you a fortune!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Why Huntley Wealth?

Are you shopping for affordable life insurance? Then be sure to give us a call at Huntley Wealth.

We specialize in high risk life insurance for those with pre-existing health conditions, so you can feel confident that the premiums we generate for you are the best possible for your particular circumstances.We have access to over 40 of the best life insurance companies in the industry and will find you the lowest possible rates.

From bad hearts to missing parts, we’ve got you covered! Call Huntley Wealth right now at 888-603-2876 we can help!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.