Pennies From Heaven Strategy

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Listen closely…Because I’m about to open up my bag of life insurance savings tricks and share the best I’ve got.

By far, this is the quickest and easiest way to save big on life insurance, and it takes seconds to find out if you qualify.

It’s called the Pennies from Heaven Strategy!

Save Big With The Pennies From Heaven Strategy

If you want to save BIG on life insurance, there’s one thing you need to understand.

Most life insurance policies do NOT “replace your income” if you die.

And that makes NO sense because:

LIMRA says income replacement is one of the *key reasons most people buy life insurance.

It gets worse, most people are overpaying for coverage that pays out as a single lump sum death benefit when they could be saving 10-30% by getting a policy that does what they actually want it to do.

Provide income to their family.

Enter our exclusive “Pennies from Heaven Strategy.”

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How the Pennies from Heaven Strategy Works

It’s very simple:

While most policies provide a one-time lump sum payment to your beneficiaries, at Huntley Wealth, we use the Pennies from Heaven Strategy to provide them with a consistent income stream over a period of time such as 5, 10, or 20 years.

In a traditional policy, your beneficiaries don’t have the option to get their life insurance money paid out to them monthly or yearly.

You know… the way income actually works!

Instead, your beneficiary gets a big lump sum of cash to figure out how to use wisely.

The good news is at Huntley Wealth, we’re pros at saving our clients money and know how to custom design our term policies for income replacement, and they’re 10%-30% cheaper than regular term policies.

The best part?

You could Apply and Save 10% to 30% on your life insurance purchase TODAY!

Use Our Quote Form Here to Get Started.

CASE STUDY

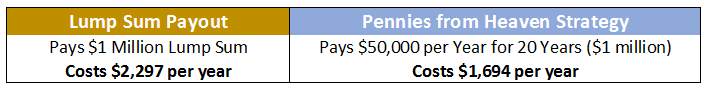

Recently, I was quoting a 50-year-old gentleman a $1 million, 20-year term policy through Banner Life Insurance for $2,297 per year.

My client admitted it was a fair price, but he was on a tight budget and asked if we could do anything to lower the premium.

My answer was YES!

(You could probably even save on your existing coverage if you already have a policy.)

Ok, back to my story…

My client had explained to me the reason he wanted $1 million of coverage was to replace his income ($50,000 per year) for his wife for a period of 20 years.

“Let me ask you something,” I said.

“It sounds like she needs income rather than big $1 million policy. Is that right?”

He agreed.

So I told him about the Pennies from Heaven Strategy:

So, you see, instead of looking at the conventional lump-sum term policies, we switched gears and talked about policies with a “fixed income” death benefit payment.

There are a handful of companies who allow you to designate a fixed payment for a fixed number of years as the policy’s death benefit, rather than a lump sum benefit.

I ran some numbers for my client and found a 20-year policy through Protective that was only $1,694 per year.

…that’s a savings of $603 per year.

Rather than paying a lump sum upon his death, his wife will receive $50,000 per year for 20 years.

In the end, she still gets the same benefit, $1 million, but at a heavily reduced cost.

Who Qualifies for the Pennies from Heaven Strategy?

NOW – Let’s see if you’re a fit for the strategy.

If you’re looking to:

- Purchase your first policy

- Have no existing coverage

- And if you would want to leave your wife or kids $50,000 per year for 10 years

… You qualify!

You WILL save money with the Pennies from Heaven Strategy in *99% of all cases.

*The only exception would be if you got approved by one of our “Pennies from Heaven” carriers at a very poor health rating, but got approved by another company at a much better health rating… It’s never happened before but I suppose it could.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Others Who Benefit from the Pennies from Heaven Strategy

A fixed payment death benefit could also be perfect for the following scenarios:

- Income Replacement: If I want my spouse to have $100,000 per year of income for 30 years to replace the income I would have earned, it will cost be substantially less to pay for a policy with this exact payout than for a $3 million policy.

- Alimony or Child Support: Many divorce decrees mandate a spouse to provide a certain dollar amount to an ex-spouse for a specified number of years. People often use life insurance to provide a guarantee on these agreements. Why not get life insurance that provides the exact amount needed for the exact time frame, rather than paying your ex-spouse a lump sum?

- Irresponsible or Inexperienced Beneficiary: Perhaps your loved ones are young or inexperienced with money and wouldn’t know what to do with a lump sum. Or maybe you simply don’t trust them to prudently manage a large sum of cash. Paying them annually can help them manage the money better.

- Special Needs Beneficiary: If your beneficiary is incapacitated or has a disability, a fixed payment death benefit can save both you and them money. If a special needs trust has been set up for the individual, the trustee would need to manage a lump sum death benefit, and would likely charge for it. Using a fixed payment death benefit could reduce those costs.

Apply and Save 10% to 30% on your life insurance purchase TODAY!

Does it Work if I Already Have a Policy or Am Replacing a Policy?

Now, the Pennies from Heaven Strategy is designed to beat the pants off of any other offer you can find in the market, period!

But what about if you already have a policy?

For example, you bought a 20 year term policy 5 years ago and you want to see if you can save money using our strategy.

Here’s the thing.

A couple of things have happened in the last 5 years since you bought your first policy.

- You’re now 5 years older – (Life insurance costs more as we age.)

- You may now have some health issues you didn’t have 5 years ago

That being said, we can still usually save you money even if you got a policy years ago.

It’s just not as much of a slam dunk as if you’re buying a new policy without trying to beat an old rate.

Where Can You Get This Benefit?

The feature is called an Income Protection Option or Death Benefit Income Rider.

Protective and Transamerica are the biggest providers that have some form of this “modified” death benefit option, but a handful of other life insurance companies also offer it.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How to Save BIG with the Pennies from Heaven Strategy

The biggest savings (20% to 30%) will be found if you stretch the income payment out over 20-30 years.

IMPORTANT: Again, we’re talking about the time period your beneficiary gets the money, not to be confused with a 20-30 year term policy.

You can buy a 10 year term policy, and elect for the beneficiary payments to be spread out long term.

Shorter Payout Periods Equal Less Savings

If you elect to have your beneficiary receive the money over 10 years, that will typically save you about 10-15%.

How the Payouts Work

Under a typical policy, the beneficiary can elect how he or she would like to receive the death benefit, whether as a lump sum, or annual payments.

But with Protective’s fixed payment death benefit, the policy owner decides the terms of the payment upon issue of the policy.

In other words: It’s set in stone. The beneficiary can’t change it.

Combo Lump Sum and Income

Lots of folks elect to have a small lump sum benefit paid out immediately, like $50K-$100K for immediate needs, and the rest of the death benefit to be paid out using the Pennies from Heaven Strategy.

This also saves you money, but not as much as if the entire benefit is spread out.

Transamerica’s benefit is also a bit different than Protective’s in that Transamerica forces you to take a minimum death benefit as a lump sum of $10,000.

Then the annuity payments begin for a fixed period of years, and then there’s even the option for a back end lump sum to be paid out.

Protective has the front end lump sum option but doesn’t have a required minimum. It also doesn’t allow for a balloon payment at the end.

Uses for Immediate Death Benefit

In either case, getting a lump sum at the beginning may be a good idea. This amount can help cover immediate needs like burial expenses, unpaid medical bills or debt repayment.

But even with a large lump sum upfront and fixed payments for a period, you’ll still save money by choosing this strategy over a conventional term policy.

Lower Your Life Insurance Premiums With This “Modified” Death Benefit

If you structure the death benefit with the fixed payment plan, no regular term policy can beat the price.

…feel free to challenge me on this.

Bring me a quote from any low price term provider such as Ohio National, Banner Life, or even an agency such as Select Quote, and don’t even get me starting with saving on life insurance by joining AARP if you’re over 50… nothing close to what we can do for you. I will almost certainly beat the quote and beat it handily.

One thing to keep in mind, however, is that a portion of these fixed payments may be taxable. The payments the beneficiary receives includes an assumption of supposed annuity interest.*

For a quote comparison, call us at 888-603-2876. If you found this article helpful, please share it on social media.

* According to LIMRA, the life insurance research, and marketing organization, “income replacement” is the 3rd biggest reason people buy life insurance.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.