MetLife Life Insurance Reviews

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

What’s New in 2021 For Metlife Insurance

How Has COVID-19 Affected Metlife Insurance?

MetLife has begun reevaluating how they handle their motor vehicle accidents and property claims to adjust to their clients’ needs. According to its CEO, these policy changes ensure that the company will proactively react to the swift changes to the post-COVID market.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

New Products or Changes

Covid-19 brought with it various new challenges. In response, MetLife has adjusted some of its policies to adhere to customer expectations. Some of the new steps implemented include stress testing the company’s infrastructure and creating new alternatives for any aspect of the system that may be affected.

Furthermore, to ensure that all customers receive the services required, Metlife keeps supplemental employees available in case of illness. As always, Metlife ensures customers that it will continue to meet expectations.

They are also conducting these efforts locally to ensure they adhere to local regulations regarding the pandemic.

MetLife Insurance on the News

Due to the pandemic, MetLife has been in the news due to its fluctuating stock prices. Like many comparable insurance companies, MetLife experienced a swift decline in its stock prices due to Covid-19 but has steadily seen an increase since the beginning of 2021.

Latest Company Reviews

Many reviews for MetLife have been positive, focusing on its customer service and identity theft protection included in its coverage. According to Nerdwallet, MetLife has received 3.5 out of 5 stars, mainly thanks to its thorough insurance plans and overall transparency.

Some of the company’s negative reviews focused on their customer service. However, many of these reviewers noted that they were leaving feedback before purchasing a policy. In terms of customer reviews of the company’s service and offerings, feedback skews more positively.

Others have recently complained about inconsistencies with their monthly billing, as the rates increased each month. Some customers complained about their 401ks, as their contribution was late.

More positive reviews were mainly focused on swift service when filing a claim. Prompt service is a highlight with MetLife, and customers praised the company for ensuring that no expenses were outstanding after deductible payment.

One should keep in mind that there is a notable difference in reviews regarding MetLife’s home insurance service and its auto insurance service. While there is no significant downside to the company’s auto insurance service, customers do hold MetLife’s home insurance services in a higher regard.

Are you considering buying a policy from MetLife Life Insurance Company? If so, this is a review you can’t afford to miss. MetLife Life Ins is a household name and with Snoopy as their mascot how could you not love them…but what do you really know about this life insurance company?

If you’re looking to get the best life insurance for your family, I have some insider secrets to share with you before you commit to MetLife individual life insurance. So, let’s get started!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

MetLife Life Insurance Company History

The company had a rocky start when it was first formed by a group of New York City businessmen during the Civil War in 1863. Originally named National Union Life and Limb Insurance Company. It was set up to protect soldiers and sailors from wartime disabilities.

By the end of the war, the company had only sold 56 accident policies and 17 life insurance policies while operating at a deficit.

After 5 more tumultuous years and name changes, the company was taken over by James R. Dow. He decided to drop the casualty aspect and focus strictly on life insurance.

As such, Metropolitan Life Insurance Company (MetLife) was born commencing business on March 24, 1868.

The company’s first head office consisted of 2 offices with room for 6 employees. MetLife struggled through the great depression and in 1879, began to investigate the successful “working man’s” insurance programs commonplace in England.

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

Applying this system and sales approach, life insurance MetLife soon began to sign 700 new industrial policies per day! So successful was the new venture, that by 1909 MetLife Metropolitan life insurance company became the largest life insurer in America. This successful company continues to maintain that leadership position in North America to this day.

Quite an astounding feat and one which shows that the spirit of determination and innovation conquers all. MetLife Inc. is now an international company that sells all manner of insurance, annuities, and employee benefit programs to over 90 million global customers.

MetLife individual life insurance holds leading market positions in the U.S., Japan, Asia, Europe, the Middle East, and Africa.

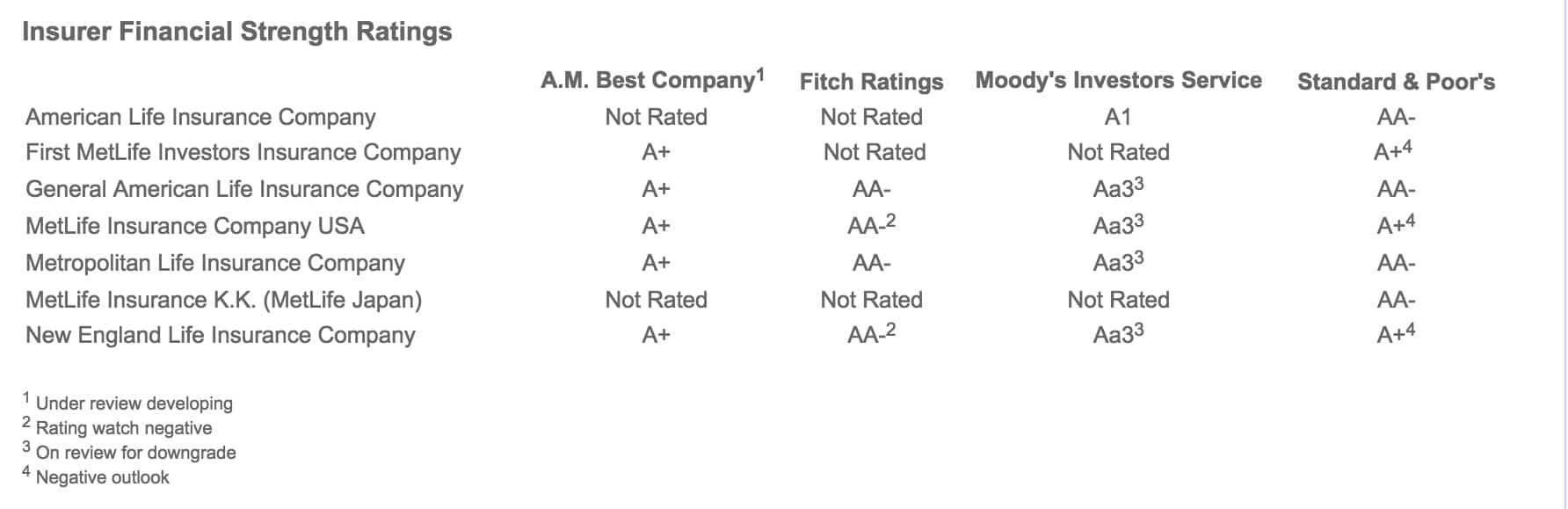

MetLife Life Insurance Ratings – Financial

Every life insurer is measured by its financial strength. If your family is in the unfortunate position of having to make a claim you want to make sure that the insurer you pick is financially stable and will be about to honor its obligations.

If you are about to choose a life insurer to be sure to do your homework! Financial ratings make this an easy process.

Insurance companies are rated by five major rating services. Each service uses its own criteria to issue a “report card” for the companies it rates. Although each service uses an alphabetical rating scale, an A+ from one service may not mean the same as an A+ from another. 360 Degrees of Financial Literacy, How Insurance Companies Are Rated

In the U.S., there are organizations that specialize in performing a very comprehensive analysis of the financial security of life insurers. They are known as financial rating companies.

Each year these rating companies take an in-depth look at how various insurers are performing.

Here’s a snapshot of just how financially stable life insurance MetLife is. Check out the results below:

It’s pretty clear that you can buy a policy from MetLife Life Insurance Company with full confidence in their ongoing financial stability. This is a solid company.

MetLife Life Insurance Company Products

So what sort of products does MetLife life insurance sell?

This established company sells a wide range of life insurance products that include:

- MetLife Term Life Insurance

- MetLife Guaranteed Acceptance Life Insurance

- MetLife Whole Life Insurance

- MetLife Universal Life Insurance

Let’s take a quick look at what their products offer in greater detail:

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

MetLife Term Life Insurance Review

MetLife term life insurance offers 3 different types of term life insurance products which can be used in a variety of different circumstances. Term life is by far the most affordable form of life insurance to buy.

All you have to do is choose the number of death benefits and length of the term that you want the insurance in place. MetLife term life insurance quote offers 10, 15, 20 and 30-year terms.

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

Policies over the face value of $100,000 are offered as fixed-term insurance, which means that the premiums and coverage stay the same over the life of the term. The 3 types of term life insurance quotes MetLife offers include:

Level Metlife Term Life Insurance

This policy is available for death benefits of $100,000 and above. The premiums are guaranteed for the term you purchase.

One Year Metlife Term Life Quote

If you need a short term life insurance solution for a business or personal loan, this is an ideal choice. You may convert this policy to a permanent policy after 1 year, and there are renewable options which can extend coverage 5 years.

Simplified Issue Metlife Term Insurance

This is a no-exam option for coverage amounts under $100,000. You can apply for this policy online or by phone and receive approval in as little as 24 hours.

MetLife Whole Life Insurance Review

Whole life insurance is more costly than term because it covers you for your entire life, provides death benefits and a cash value accumulation feature.

Part of your premium is applied to the cash-value account, which continues to grow throughout the life of the policy. Both the death benefits and the cash value portion are non-taxable.

It is our opinion, that for most people, the term is the right fit and there are better investment vehicles for saving your money. That being said, if you happen to be in the category of people that would benefit from purchasing a Metlife whole life insurance has 2 options for you:

Metlife Whole Life Insurance

This is a very straightforward type of policy which quarantines your premiums, death benefits and cash value accumulation. Dividends may also be payable but are not guaranteed.

Metlife Guaranteed Acceptance Whole Life Insurance

This policy has much lower coverage ($2,000 – $20,000). Guaranteed acceptance whole life is ideal to cover items such as medical bills, debts and funeral costs. The best part? You cannot be declined between the ages of 50 – 75 because of health reasons.

Click here for information on MetLife Whole Life Insurance!

MetLife Universal Life Insurance

Universal life insurance is another form of permanent life insurance. It is very similar to Whole life with the added feature of greater flexibility in regard to how you manage your premiums and death benefits.

Additionally, Metlife Universal Life Insurance policies also give you more control over how the cash value accumulation portion of the policy is invested. MetLife has several Universal policy types including:

- Metlife Universal Life Insurance: Lets you choose the length of the protection guarantee and premium schedule. Both are guaranteed as long as the premiums are paid.

- Variable Metlife Universal Life Insurance: Offers an insurance rider at an additional cost which guarantees a minimum death benefit regardless of how the investment portion performs. Also provides loan and withdrawal options.

- Survivorship Life Insurance: Provides coverage for 2 people where the benefits are provided after the second person dies. Can be used to equalize your estate, provide care for a special needs child, or for estate tax purposes.

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

MetLife Life Underwriting Comparison

Underwriting guidelines vary substantially from company to company.

A little insight into how life insurers view your particular circumstances will save you thousands of dollars over the course of your policy.

For comparison purposes, I am going to show you how MetLife Life Insurance policy compares to Transamerica Life Insurance and Protective Life Insurance.

Let’s check these companies out!

I am going to review their guidelines for a “Preferred Plus” Term life policy for a male who is at 5’ 10 “tall. The rating features will examine the following 5 factors typically assessed:

- Weight and Build

- Smoking

- Blood Pressure

- Cholesterol Levels

- Family History

Get a Quote from Our Best Priced Company

Met Life Insurance (Elite Plus)

Height Weight: A 5’ 11” male can be no heavier than 193 pounds

Tobacco Use: No nicotine use for the past 60 months and negative nicotine test.

Blood Pressure: Ages 40 and Under (130/80), Ages 41 – 54 (135/85), Ages 55 – 69 (140/85), Ages 70 and Over (140/90).

Cholesterol HDL Ratio: Ages 54 and under (220/4.5), Ages 55 – 69 (230/4.5), Ages 70 and Over (140/90).

Family History: No cardiovascular disease or cancer (some cancers may qualify) in either parent or siblings before age 60.

SUMMARY OF MetLife Life Underwriting

After reviewing Metlife’s underwriting guidelines and comparing them to Transamerica and Protective we have identified a number of strong niche areas that should be explored.

- If you happen to suffer from any of the pre-existing medical conditions below, Metlife may be the life insurance company for you:

- Type 1 Diabetes

- Type 2 Diabetes

- Active Duty Military Service Personnel

- Blood Pressure

- Marijuana Users

There are numerous factors that are considered when underwriting a life insurance policy. First, an underwriter will need to determine the probability of an applicant’s life lasting as long – or even longer – than the “average” life expectancy for an individual of that particular age and gender. What is Underwriting and How Does It Work?

MetLife life insurance policy has a number of areas where they provide lenient underwriting guidelines and like all life insurers there some areas where they are more stringent. Overall we find this to be a very competitive company from an underwriting perspective.

It’s imperative for you to contact an independent life insurance agent to help you find the most forgiving company for your particular health circumstances.

How Does MetLife Life Insurance Quote

So what about the money? Of course, you are looking for affordable premiums and the best possible coverage.

To give you some cold hard numbers to crunch, I am going to provide a quick snapshot of how Metlife compares to Transamerica and Protective price-wise.

I am using projections for a client who qualifies for a Preferred Non-Tobacco policy with $250,000 in coverage for a 20 Year Term.

MetLife Term Life Insurance Quote

- 30 Year Old Female – $12.74 monthly, $141.40 annual

- 40 Year Old Female – $17.69 monthly, $196.50 annual

- 50 Year Old Female – $36.59 monthly, $406.50 annual

- 30 Year Old Male – $14.31 monthly, $159.00 annual

- 40 Year Old Male – $21.51 monthly, $239.00 annual

- 50 Year Old Male – $47.84 monthly, $531.50 annual

Protective Life Insurance Quotes

- 30 Year Old Female – $12.03 monthly, $139.81 annual

- 40 Year Old Female – $16.67 monthly, $193.82 annual

- 50 Year Old Female – $34.58 monthly, $402.12 annual

- 30 Year Old Male – $13.39 monthly, $155.65 annual

- 40 Year Old Male – $19.71 monthly, $229.21 annual

- 50 Year Old Male – $45.68 monthly, $531.21 annual

Transamerica Life Insurance Quotes

- 30 Year Old Female – $12.47 monthly, $145.00 annual

- 40 Year Old Female – $20.21 monthly, $235.00 annual

- 50 Year Old Female – $39.56 monthly, $460.00 annual

- 30 Year Old Male – $14.84 monthly, $172.50 annual

- 40 Year Old Male – $24.30 monthly, $282.50 annual

- 50 Year Old Male – $49.02 monthly, $570.00 annual

MetLife term life insurance quote has some of the most competitive term life insurance rates available. The quotes reveal that for both males and females MetLife often ranks in the top 5 – 10 lowest premiums rates in the industry.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Bottom Line Of Metlife Life Insurance Company

Based on the availability of products, underwriting criteria, and premium costs, MetLife life insurance reviews can be summarized as follows:

- Excellent range of life insurance products and riders

- Very competitive for a variety of health issues

- Offers some of the lowest term rates in the industry

Who do we think rate as the top 10 life insurance companies in the industry? We urge you to read this article: “The Top 10 Life Insurance Companies 2020.”

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.