Lemonade Renters Insurance Review: Cost, Coverage, and More

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

We all know what a struggle it can be to find an affordable renters insurance policy these days. You want a policy that fits your budget and provides you with the protection that you need for you and your loved ones.

Lemonade Renters Insurance promises to be unlike any other renters insurance company on the market.

Lemonade Renters Insurance also guarantees that everything’s instant (from signing up for a policy to filing a claim) and that they have incredibly low prices.

This is why we’re going to review Lemonade Renters Insurance. We’re going to take a look at the cost, coverage and everything else you could possibly want to know about Lemonade Renters Insurance to see if the company can back up these promises…

Before we get started with breaking down the cost of Lemonade Renters Insurance coverage, we’re going to take a look at the company…

What’s Lemonade Renters Insurance all about?

Lemonade claims to be unlike any other renters insurance company with its unique business model.

Lemonade came on the market in 2015 with a new business model in the insurance space.

According to the official website of Lemonade, here’s how Lemonade Renters Insurance stands out:

“Lemonade reverses the traditional insurance model. We treat the premiums you pay as if it’s your money, not ours. With Lemonade, everything becomes simple and transparent. We take a flat fee, pay claims super fast, and give back what’s left to causes you care about.”

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How’s any of this even possible with Lemonade Renters Insurance?

The company doesn’t employ any sales agents and everything’s done online or through the mobile app.

Lemonade says that you can get a renters insurance quote in 90 seconds and file a renter’s insurance claim in 3 minutes.

This almost doesn’t even seem feasible since we all know how tedious the process can be when it comes to enrolling for any kind of insurance policy or what a hassle filing a claim can be. This is why we will be testing out the sign up process later in this review as we look through the Lemonade Renters Insurance coverage.

Lemonade Renters Insurance contact info.

What if you have to contact Lemonade Renters Insurance about something?

All communication is done through the website or the mobile app.

Here’s the contact information for Lemonade Renters Insurance:

- Website: www.lemonade.com

- Phone: (844) 733-8666

- Address: 5 Crosby St. 3rd floor, New York, NY 10013

How much does Lemonade Renters Insurance cost?

We can’t ignore the price of an actual renters insurance policy since most of us are looking for something that fits our budget since we already have enough expenses to worry about.

The cost will depend on what state you live in and your situation (how much coverage you need, your past claims history, the safety of your unit and so on).

We looked into actual Lemonade Renters Insurance policies to obtain the most realistic prices. The next section looks at prices from New York and California for Lemonade Renters Insurance.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How do you get a Lemonade Renters Insurance quote?

You can get a quote immediately on the Lemonade Insurance page. We obtained a quote in minutes and then were able to customize every aspect of the coverage.

Here are the questions that you should expect when obtaining a Lemonade Renters Insurance quote:

- You full name.

- Your address.

- What kind of safety features does your unit have (fire alarm, burglar alarm, security locks, etc.)?

- Who lives in the unit with you (roommate, kids, pets, or partner)?

- Do you own any valuable/expensive items that need to be insured?

- Are you currently insured?

- Your email and birthday for a quote.

The questions may variety on which state you live in. Once you go through the simple process, you’ll be presented with a Lemonade Renters Insurance quote. From there you can customize every aspect of your renter’s insurance policy.

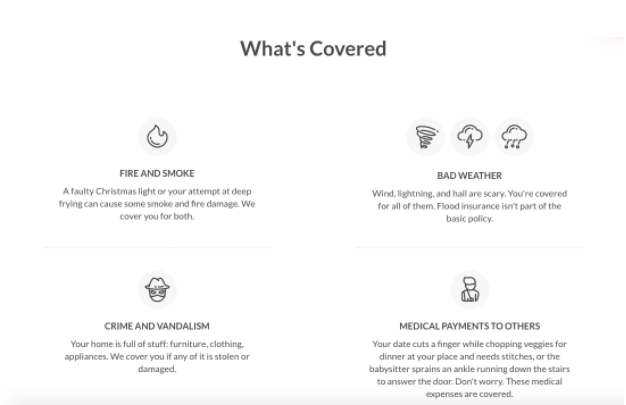

What kind of coverage comes with Lemonade Renters Insurance?

As you already know, your level of coverage with a renters insurance company is everything.

What levels of coverage should you expect with Lemonade?

We looked up Lemonade Renters Insurance quotes for New York and California for this review.

Here’s the level of coverage that you can expect in New York for $14.17/month:

- Personal property coverage at $40,000

- Personal liability coverage at $100,000.

- Loss of use coverage at $15,000.

- Medical payment to others at $1,000.

- Deductible of $500.

Here’s the level of coverage that you can expect with Lemonade Renters Insurance in San Francisco for $17.59/month:

- Personal property coverage at $50,000

- Personal liability coverage at $100,000.

- Loss of use coverage at $15,000.

- Medical payment to others at $1,000.

- Deductible of $500.

We dropped the personal property coverage to $30,000 to see what the rate would be like when you don’t own that much stuff. The monthly renter’s insurance policy dropped to $11.34/month.

Please note that a variety of factors will determine your monthly renter’s insurance quote from Lemonade. Your past history and the safety of your unit play a critical role.

What does this coverage actually mean? Let’s break it down.

Personal property coverage.

This standard coverage will replace your personal property that gets damaged or stolen due to a covered protection.

The coverage here with a basic policy is $40,000 so that means that if your place were to get damaged due to a kitchen fire or something along those lines, you would have your furniture and other personal possessions replaced up until $40,000 (this includes your favorite jeans and cell phone).

Keep in mind that renters insurance is different than homeowners insurance.

Personal liability coverage.

This will protect you legally in the event that somebody were to get hurt on your property and then try to sue you.

The personal liability coverage with Lemonade Renters Insurance starts at $100,000 and would cover all of the legal fees associated with the process.

Loss of use coverage.

If you can’t live in your place due to a covered loss or damage, your living expenses will be covered. This includes everything from the hotel costs to your meals.

The coverage here starts at $12,000, so that means that if your unit is unlivable you have this amount of money to cover your living expenses until the unit is ready for you.

This means that you can move into a hotel or Airbnb unit without stressing about the costs associated with such a move.

Medical payments to others.

If a guest were to get injured on your property, their medical expenses would be covered.

The official Lemonade Renters Insurance website clearly describes what’s covered and what’s not covered with your policy.

That’s the coverage that you can expect with Lemonade Renters Insurance. Please keep in mind that you can adjust your deductible or your coverage amounts if you want to lower the cost of your renter’s insurance policy or are looking to customize every aspect.

What’s not covered with your Lemonade Renters Insurance?

As important as it is to go over what’s covered, we have to take a look at what isn’t covered with a Lemonade Renter’s Insurance policy so that you know what to expect.

What’s not covered with a basic Lemonade Renters Insurance policy?

- High-risk dog attacks. You won’t be covered in the event that your dog were to attack someone.

- Earthquakes. This type of coverage always varies in importance depending on where you live.

- Floods. You may be covered from a bath tub overflowing but you wouldn’t be protected from a flood due to a natural disaster.

- Roommates. Your roommates’ belongings or personal injuries would not be covered.

- Expensive items. You have to add extra coverage for items like bikes, fine art, jewelry, and so on.

The Lemonade Renters Insurance website goes into detail of what to expect with your renter’s insurance policy.

As always, it’s critical that you go over your renter’s insurance policy to ensure that you have enough coverage for your situation.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

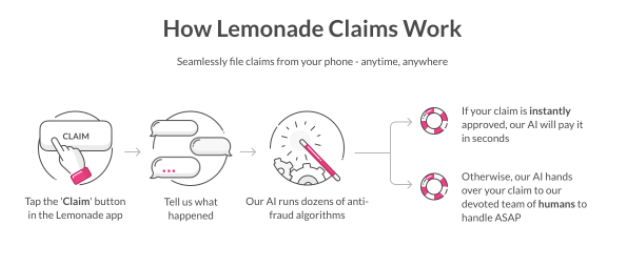

How do you file a claim with Lemonade Renters Insurance?

As important as the price is, we can’t ignore the claims process. Hopefully, you never have to file a renters insurance claim, but speaking from experience, you want the process to be as smooth as possible.

How do you file a claim with Lemonade Renters Insurance?

- You use the mobile app or the website for the entire process.

- For an emergency, you can contact: (844) 733-8666

Lemonade notes that 30% of claims are instantly approved over the app and that you can file a claim within 3 minutes.

What does this mean? Traditionally speaking, you would have to call an agent to speak with about a claim and wait to hear back from there. With no agents, everything’s done over the app.

According to the official Lemonade Renters Insurance website, here’s when you should expect a claim to be paid out:

“Our goal is for the majority of simple property claims to be paid almost instantly. For a pet health insurance policy, this could mean covering the costs of a procedure or test before leaving your vets reception. There will be cases in which we’ll need to fully review the incident to approve the claim, and there will be property damage claims or liability claims that may take longer to settle.”

As a reminder here are the steps to follow before making a renter’s insurance claim:

- Contact authorities to file a police report if anything has been stolen or damaged.

- Document any damages with photos or videos.

- Look for receipts.

- File your claim through the mobile app.

Here’s a screenshot of the Lemonade Renters Insurance claims process…

What are the pros and cons of Lemonade insurance?

Here are a few things that you have to keep in mind. There are positives and negatives to using Lemonade for your renters insurance needs.

What are pros of Lemonade Renters Insurance?

- Low rates.

- Everything is simple.

- You can opt out at any time.

- Low deductibles (they start at $250).

- Your spouse is added to your policy for free (it only costs a few dollars to add a significant other).

- The website is helpful.

What are the cons of Lemonade Renters Insurance?

- Not rated by A.M Best for financial stability yet.

- Still relatively new to the industry.

- Not available in all states.

- No insurance bundling options if you’re looking for auto insurance or any other kind of insurance.

What else do you need to know about Lemonade Renters Insurance?

There are a few other key items that we wanted to mention about Lemonade Renters Insurance to make this review complete.

Lemonade explains everything on the website.

We were impressed with how detailed the website is when it comes to explaining renter’s insurance and what to expect with your coverage. This is helpful for anyone who’s confused about insurance.

Lemonade doesn’t have any sales agents.

You buy your policy on the app and you can do everything online from the convenience of your own couch. You don’t have to deal with a pushy salesperson.

The Lemonade app has a 4.9 rating on Google Play and the App Store

The Lemonade Renters Insurance app is highly rated and this is a good sign because everything is done through the mobile app (from filing a claim to updating your policy).

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Is Lemonade Renters Insurance available in my state?

As we mentioned earlier, Lemonade isn’t available in all states just yet. Here’s a list of states where you can find Lemonade:

Arizona, Arkansas, California, Colorado, Connecticut, District of Columbia, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Virginia, Washington, and Wisconsin.

Lemonade Renters Insurance Review Reddit – Honest Customer Reviews

When you are looking for honest reviews you think of Reddit. Luckily, Lemonade Renters Insurance Review Reddit is a thing!

The reviews are mixed, some customer’s reviews love the discounted renters insurance. While others complain about some customer service issues.

Final thoughts on Lemonade Renters Insurance…

That’s our review of Lemonade Renters Insurance. We found that Lemonade has some of the lowest rates in the industry along with the simplest process for enrolling in a policy and filing a claim.

We just wish that Lemonade Renters Insurance was available in more states and the company had an A.M Best rating for financial stability.

As always, we urge you to obtain a renter’s insurance quote to see what options are available to you with Lemonade Renters Insurance.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.