Help End GoFundMe Life Insurance Requests: #GoFundMeRebellion

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Insurance Agent

UPDATED: Mar 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

It’s getting out of control, and everyone is frustrated by it. A loved one passes away, and within days, the GoFundMe campaign shows up on your Facebook feed…

“Requesting Help for Funeral – Joe had no Life Insurance :(” It’s sad. It’s frustrating. It’s awkward. And it pisses a lot of people off!

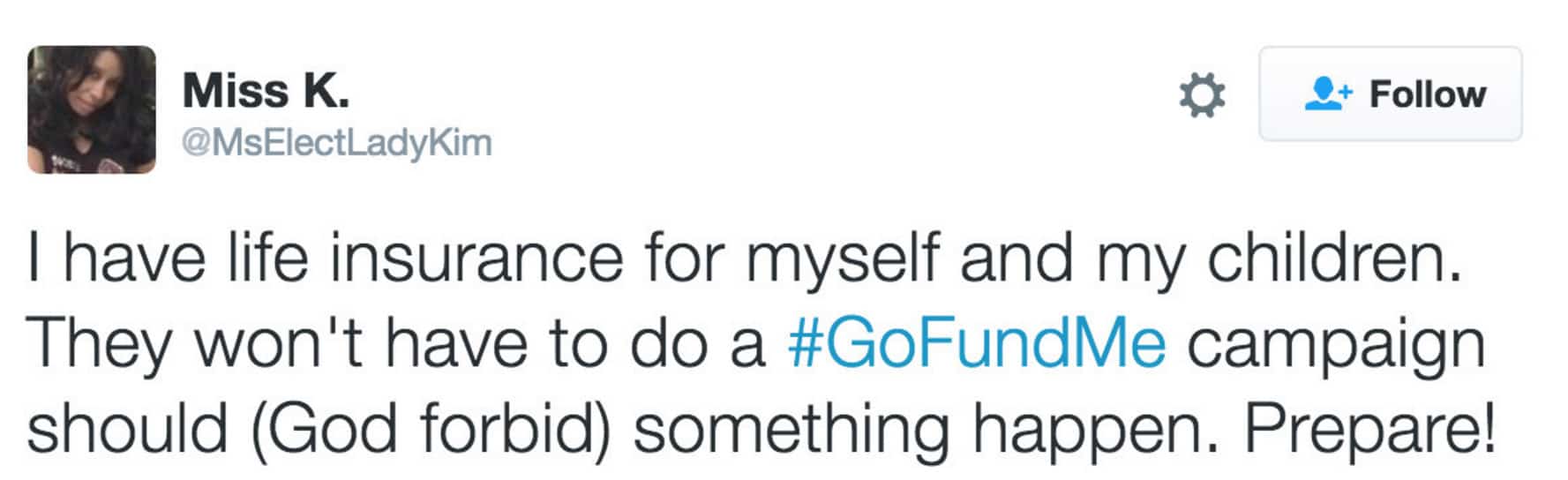

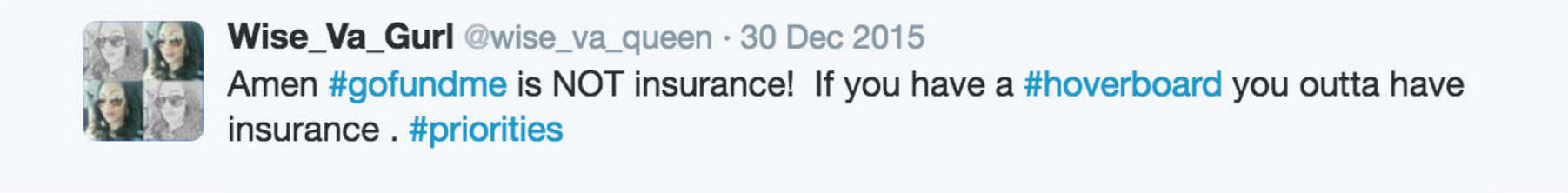

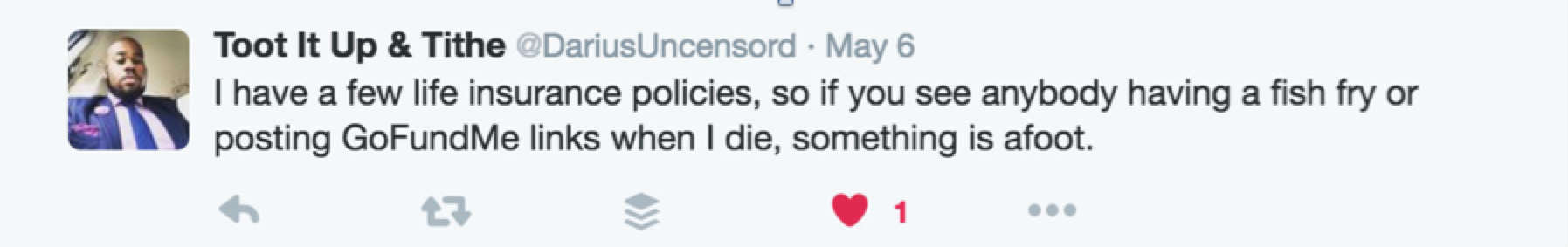

Take a look at what people are saying on Twitter:

Click here for more tweets. Some of these are hilarious!

I say they’re right! If you agree, find out how you can help end these campaigns in 3 easy steps.

Welcome to the GoFundMe Insurance Rebellion!

The GoFundMe rebellion is about tough love.

It’s like telling your 32-year-old son with no job who won’t move out of your house and sits around on your couch playing video games naked eating Cheetos, that he has 3 months to either move out or start paying rent. Guess what. He’ll get his ass off the couch and start looking for a job!

… Tough love.

What happens every time people see these campaigns get funded? They subconsciously decide that planning for death just isn’t that important because someone else can bail my family out. And on goes the cycle.

Want to help stop GoFundMe life insurance campaigns? Stop contributing to them.

Take the “Fund” out of “GoFundMe”, and we’ll end the cycle.

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

When You Should Call BS on a GoFundMe Campaign (and when you shouldn’t)

Some GoFundMe campaigns have their place – you know them when you see them. We’re not here to stop campaigns raising $20,000 for that surgery that your health insurance didn’t cover. We’re here to fight for this noble idea:

Go Fund Me Campaigns should be used for expenses that responsible people never saw coming.

Could a responsible person possibly foresee and plan for an unexpected death? You bet.

So if Joe is a healthy, 50-year-old and suddenly dies of a heart attack or gets hit by a car, whether he is single with no dependents, or married with 3 kids…we shouldn’t see a GoFundMe campaign.

Why? He was healthy. That means he *could have* qualified for life insurance!

So if Joe was a middle-income American, he should’ve planned ahead, and it shouldn’t be our burden to bail his family out because he mismanaged his money. But Joe’s “middle income” example brings up a good point.

What About People Who Can’t Afford Life Insurance?

“What if they truly didn’t have the means to put any money away or buy life insurance?” First of all, I know where your heart is with this statement and I appreciate that. But seriously, do you know how much it costs for just a $100,000 term policy? If you’re under 50 and healthy, typically under $20 bucks per month!

You’ll have to be the judge of how you respond to the GoFundMe requests from low-income families.

If they’re struggling just to make ends meet and pay for the essentials – food, clothing, housing, etc., then I can see sympathizing and helping a family out who truly could not have “saved up” or bought life insurance to prevent the need for a GoFundMe campaign.

But if I can picture Joe’s wife writing the GoFundMe request on her iPad while sipping a White Chocolate Mocha at Starbucks, you be the judge of whether or not you want to contribute, but hell no, I’m not helping!

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Want to Help End Irresponsible GoFundMe Insurance Requests?

We can end these requests in 3 easy steps:

1. Make the Pledge – see below

2. Stop contributing to GoFundMe insurance campaigns

3. Share the Rebellion

Instead of GoFundMe, Buy Life Insurance

It starts with you. You’ve got to get YOUR financial ducks in a row to assure YOUR family won’t be requesting crowdsourced funds on YOUR behalf. That could mean you need to spend a bit less and save more. That could mean you need to look into buying some life insurance.

That could mean talking to your loved ones about your wishes upon your death.

Make a pledge that no GoFundMe campaign will be used upon your death, and share it on Facebook, Twitter, Snapchat, etc.

“I vow that no GoFundMe campaign will be set up upon my death, nor will I set one up for my family members. #gofundmerebellion”

Here are a few quick shareable ideas:

GoFundMe is not life insurance! #gofundmerebellion

Two Quick Announcements: 1) I am no longer contributing to GOFUNDME campaigns 2) Life insurance is super cheap – Now go do the right thing! #gofundmerebellion

LIMRA, a life insurance research association, says that people overestimate the cost of life insurance by over 3 times! It’s affordable people. Don’t rely on GOFUNDME! #gofundmerebellion

Go Fund Me Campaigns should be used for expenses that responsible people never saw coming. #gofundmerebellion

Last Thoughts on GoFundMe For Life Insurance

So if you’re a middle-income American, please stop with the Go Fund Me requests. It makes your friends and family uncomfortable.

No one should have to think about the way Joe mismanaged his money and could have bought life insurance, but didn’t.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.