[CASE STUDY] Why I Bought Pet Insurance from Healthy Paws

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Pet Insurance Could Have Saved Our Dog, Sally

If you’ve ever had to put a dog down, you know the incredible guilt and hopelessness you feel.

When my wife and I had to make the agonizing decision to put down our Golden Retriever, Sally, last year, it devastated us.

But I wasn’t content just mourning our sweet Sally.

I wanted to know:

- Would pet insurance have covered her cancer treatment?

- How much would it have paid out?

- And should we consider pet insurance for our 2-year-old dalmatian?

Let me start by saying I’m no pet insurance expert.

As many of you know, I’m a licensed life insurance agent. That’s where my real expertise lies.

But since we had to put Sally down, I’ve learned a lot about pet insurance and ultimately, I did buy a policy from Healthy Paws for our dalmatian. In this article, I’ll tell you how pet insurance would have saved Sally, and why we chose Healthy Paws for our dalmatian, Odie.

How Pet Insurance Could Have Saved Sally

I still can remember crying all the way home from the vet hospital.

I was going to have to tell my three daughters we put Sally down. For two of my kids, Sally had been part of our family their entire short lives.

More than anything, I remember feeling a tremendous amount of guilt.

Sally had cancer and the surgery to try to remove it was going to cost over $10,000. The vet’s prognosis wasn’t great. She had told us there was a 5-10% chance the surgery would “cure” Sally. But the overwhelming probability was that even with the surgery, she’d still die within 2 to 4 months.

So we had a hell of a decision to make…

Could we afford $10,000?

Well, yes and no.

Technically, yes, we had that amount in our bank account. But we have three mouths to feed and lots of bills.

In the end, we decided we simply couldn’t spend that extraordinary amount of money for a roll of the dice that almost certainly wouldn’t go our way.

But knowing we made the decision for the long-term benefit to our family didn’t make it any less brutal.

The worst part?

I learned later we could have avoided putting Sally down if she had pet insurance.

Most pet insurance plans pay between 70% to 90% of medical costs due to accident or illness.

Would we have been willing to pay $2,000 to try to save Sally?

Absolutely!

When I learned this, I was angry. Angry and disappointed in myself. I felt like I could have prevented this!

I decided I’d take a deeper dive into pet insurance to see if it would make sense for our 2-year-old dalmatian, Odie.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

The Basics of Pet Insurance I Learned

I’m a researcher.

So when I decided to take a deeper dive into pet insurance, I:

- read a LOT about how pet insurance works

- read several reviews about pet insurance companies

- and got several quotes

To make it easy for you, I’ll tell you some of the basics I learned here.

The first thing I learned was that pet insurance works a bit differently than health insurance.

You pay a premium like any insurance (your cost) but when it comes time to actually use the plan, here’s how it works:

- You can choose any licensed vet or vet hospital you want (there is no “network” of approved doctors like in health insurance PPO’s)

- You pay for the cost of treatment out of pocket

- You submit the bill to the pet insurance company

- They reimburse you for qualifying expenses

So it’s essentially a reimbursement plan.

Deductibles and Reimbursement Percentage

The plans typically have a deductible.

That’s the amount you pay before coverage kicks in. You can usually choose from $250, $500, or $1,000 deductible amounts. This amount is like the equivalent to “co-insurance” in health insurance.

Then you choose from a reimbursement percentage. That’s the percentage of the bill the pet insurance company pays once you’ve paid your deductible. You can typically choose from 70%, 80%, or 90%, although 90% is not usually available for older dogs. (For more information, read our “10 Best Pet Insurance Companies for Older Dogs“).

Max Payout or Payout Limit

Last, there is typically a maximum amount the insurance company will pay out either per year or in the lifetime of the plan. For example, you might find a plan with a maximum limit of $10,000 to $30,000 per year. One of the reasons I went with Healthy Paws is because they have an unlimited payout.

#2 – What Pet Insurance Covers

I also learned that pet insurance typically covers expenses related to an accident injury or illnesses (with no pre-existing condition).

They don’t cover pre-existing conditions and most plans don’t cover “wellness” or routine visits or check-ups. The idea is for it to pay for unexpected injuries or illnesses, not for preventative care. Some companies do offer a level of coverage that pays for these sorts of visits, but they cost a lot more than I was personally willing to spend.

Some companies also have exclusions covering certain genetic conditions that are prevalent in certain breeds, so be sure to read the fine print before you buy.

#3 – How Much Pet Insurance Costs

I also got lots of quotes.

I didn’t only pull quotes for my dalmatian. I also got quotes for other breeds just to get a good feel for a range.

Plans start around $25 per month and typically go up to around $100 per month.

If you get a plan with “the works” that covers wellness visits or preventative care, you can easily pay well over $100 per month.

Why I Ended Up Buying Coverage from Healthy Paws

After reading several reviews about different pet insurance companies, I found the companies mostly differ in the following areas:

- price

- annual limits or deductibles

- ease of claims

- what is covered?

Let’s review each of these.

Price

I fetched quotes from multiple companies including Nationwide, FIGO, PetPlan, Embrace, and Healthy Paws.

For my 2-year-old dalmatian, I was looking for a plan with an 80% reimbursement and $500 deductible.

Some of the quotes I got were as follows:

- Embrace – $98.77 per month

- FIGO – $56.49 per month

- Healthy Paws – $53.74 per month

- Nationwide – $46.72 per month

- PetPlan – $144.01 per month

As you can see, Nationwide actually had the lowest cost policy at $46.72 per month. Healthy Paws was #2. I ended up choosing them, however, due to ease of claims and that fact that they pay for alternate treatments, which I’ll cover below.

Annual limits and Deductibles

Out of the plans, I compared, FIGO, Nationwide, PetPlan, and Healthy Paws had unlimited annual reimbursement limits.

Embrace’s limit was $30,000, which in all honesty, is probably more than enough. If their price was lower, I don’t think I would care that they limit their coverage to $30,000.

Ease of Claims

Another reason I went with Healthy Paws over Nationwide was how easy they make it to submit a claim.

At Nationwide, you have to download a form, print it out and fill it out, scan it, and then email it in.

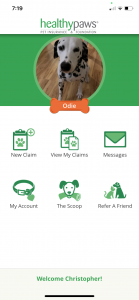

With Healthy Paws, you just take a picture of the bill with your phone and submit it to them through their app.

You can see the “New Claim” option here in their app, which I was able to download after I became a customer.

What is Covered?

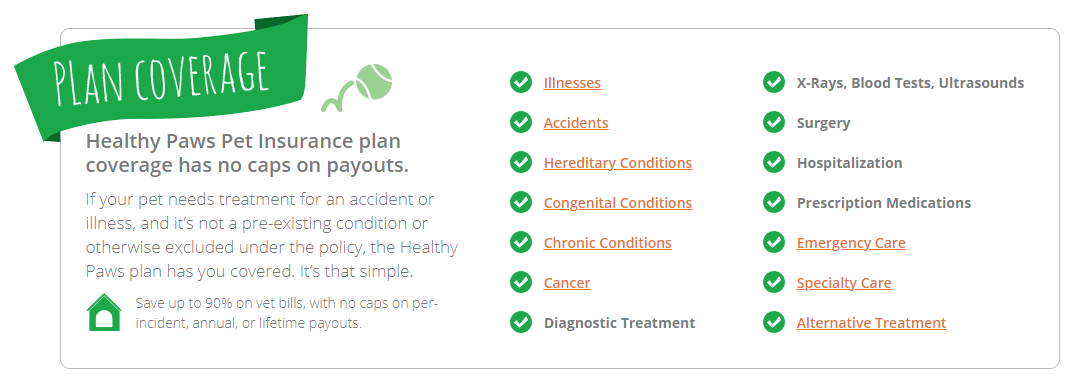

According to their site, here is what Healthy Paws covers.

Many of these are self-explanatory. A few I had to look up were:

- Hereditary & Congenital conditions – These are diseases passed down genetically from your dog’s parents. Purebreds are particularly vulnerable. Examples are hip dysplasia and cherry eye.

- Chronic conditions – these are ongoing (or even permanent) conditions that require a lot of care like diabetes, allergies, or even cancer.

- Alternative therapy – these are things like acupuncture or chiropractic

Note that many companies don’t cover or place restrictions on hereditary or congenital conditions. One of the reasons I chose Healthy Paws is because my dog will be eligible for coverage so long as the signs and symptoms first manifest after enrolling.

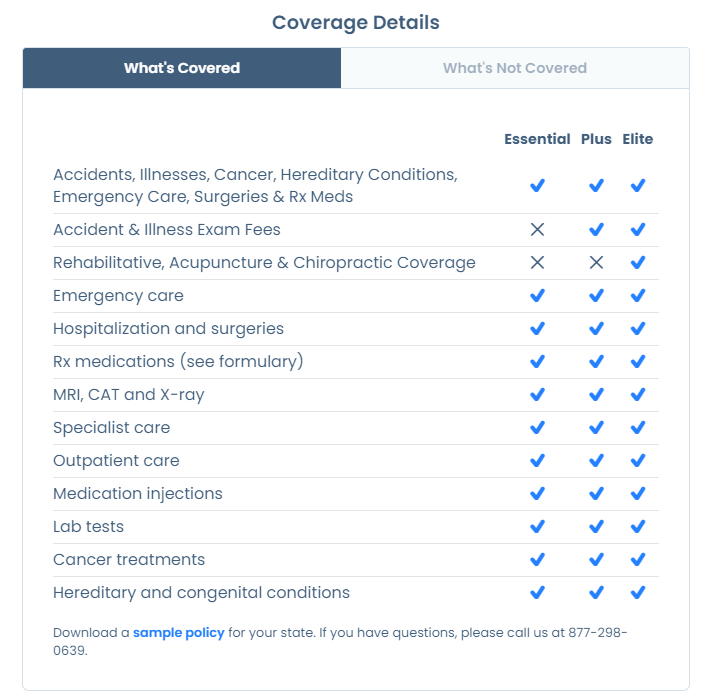

In the price section, I mentioned Nationwide actually had the best rates, but I went with Healthy Paws anyway. That’s because their Essential and Plus plans don’t cover rehabilitative treatments. Here’s what’s covered:

In the end, I went with Healthy Paws because they had a great price, covered everything I wanted and made it easy to file a claim.

In my next article, I’ll take you through the steps of getting a quote, signing up, and using the app.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.