Bristol West Insurance Review

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

So what do YOU know about Bristol West Insurance?

If you took the time to read Bristol West Insurance group reviews – you might be quickly put off!

…but guess what?

This company has a few surprising advantages!

The truth is, insurance agencies aren’t a one size fits all deal! What’s bad for one person might be the perfect fit for another.

That’s why understanding how a company suits YOUR needs is essential! So let’s see what Bristol West Insurance has to offer right now!

Bristol West Insurance

Before I get too deep into this Bristol West Insurance review, let’s take a look at the background of Bristol West Insurance Company.

When compared to many of their competitors like Safeco, this is a pretty small operation.

This insurer was founded in 1973 in Florida and they might as well be called Bristol West Auto Insurance because that’s what they sell.

In 2007, they were bought by Farmers Insurance Group, which means they’re backed by one of the biggest insurance companies in the U.S.

Jackpot, right?

Well, not necessarily. Although they do have solid support from a large and reputable company like Farmers, they still fall short in several categories.

That’s what we’re here for… to do all that boring research for you so you can make the best financial choices for your family!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Products Offered by Bristol West

One of my favorite parts of a review is exploring products… but guess what?

There’s not too much to see here.

As we’ve already established, I think of this company as Bristol West Auto Insurance because they only offer car insurance. Which means they don’t sell nearly as many products as a lot of their competitors.

The truth is, Bristol West’s auto insurance policies are PRETTY basic. Policies come equipped with comprehensive, collision, and liability coverage.

Not enough for you?

Then you may want to check out some of the additional coverage options to supplement your Bristol West Car Insurance policy such as:

Towing & Rental Reimbursement Coverage

Covers the costs of getting towed and/or renting a car while your auto is being repaired, plus the typical add on roadside assistance.

Medical Payments

If you’re injured in an accident (God forbid), Bristol West Insurance will foot the bills if you add this feature.

Underinsured or Uninsured Motorist: Bodily Injury & Property Damage

This provision covers the cost of property or injury if the culprit is lacking in the insurance department.

Customizing Equipment Coverage

CEP covers any custom parts that you’re permanently adding to your vehicle.

***Insurance products vary depending on state. You can click here to see what Bristol West Insurance products are available in your area.

Benefits of Bristol West Insurance

So, what does this company have going for them? Let’s take a sneak peek:

Pros:

- Acquired by Farmer’s Insurance Group

- Received an ‘A’ rating from A.M. Best

- You can report a claim anytime 24/7

- Low down payments

Bristol West Insurance Company is Backed by Farmers Insurance

I’m SURE you’ve heard of Farmers Insurance Group.

Well, this gives Bristol West Insurance a LOT more credibility and STABILITY!

Who doesn’t like a household name?

Bristol West Insurance/State Farm Has a GOOD Financial Rating

Bristol West Insurance policyholders should be happy to hear that the company has an ‘A’ rating!

Although these ratings go as high as an A++ — an A rating is still considered excellent. Since the Bristol West Insurance Group is backed by a titan such as Farmer’s Insurance, you can trust them to keep their head above water.

OLDWICK, N.J.–(BUSINESS WIRE)–A.M. Best has affirmed the Financial Strength Rating (FSR) of A (Excellent) and the Long-Term Issuer Credit Ratings (Long-Term ICR) of “a” of the members of Farmers Insurance Group (Farmers) and Farmers Reinsurance Company (Woodland Hills, CA). A.M. Best Affirms Credit Ratings of Members of Farmers Insurance Group, BusinessWire.com

There may be several downsides to Bristol West, but their financial strength is certainly one of their most redeeming qualities.

So why is this so important?

The financial strength of a company is calculated based on several factors, including liquidity, profitability, and solvency.

A company that tests well financially, is a company that has a firm foundation.

It looks like Bristol West Insurance is here to stay!

You Can File a Claim 24/7 on the Bristol West Insurance Site!

This is a great feature – in theory.

Now…whether or not your Bristol West Insurance claim will go as smoothly as the site makes it sound is another story which I will get into a bit later.

Low Down Payments

Fluid cash an issue? Not to worry, Bristol West Insurance offers a variety of policy terms to suit your needs. Pay your premiums in full or select a low down payment installment plan.

Downsides of Bristol West

As with anything, there are cons. Let’s check out some reasons why you might want to pause before you purchase a Bristol West Insurance policy.

Cons:

- Review sites report poor customer support

- Policies can only be purchased from Bristol West Insurance Agents

- A quote isn’t easy to obtain

- …which makes it tough to figure out how their premiums compare price-wise

As much as a I hate to do this to Bristol West Insurance – here goes…..

Don’t Underestimate the Importance of Customer Support

First off, their customer support could use some serious improvement!

While customer support is one of the more common complaints about every insurance company, Bristol West Insurance seems to have achieved new heights when it comes to client complaints!

Check out some of the online reviews for this company. Sadly there are a LOT of countless people that took the time to vent.

It’s not pretty – in fact, the reviews from their website give Bristol West a measly 1.3 stars out of 5!

Yikes.

However, it’s important to remember that personal experiences with an insurance company vary greatly.

You really need to think about what compels people to leave reviews.

If everything is going smoothly, a policyholder is less likely to leave a review. I mean, why should they? The insurance company is doing exactly what they should be doing.

…on the other hand, policyholders that have a disastrous experience with a company may feel the need to tell the world about how they were mistreated.

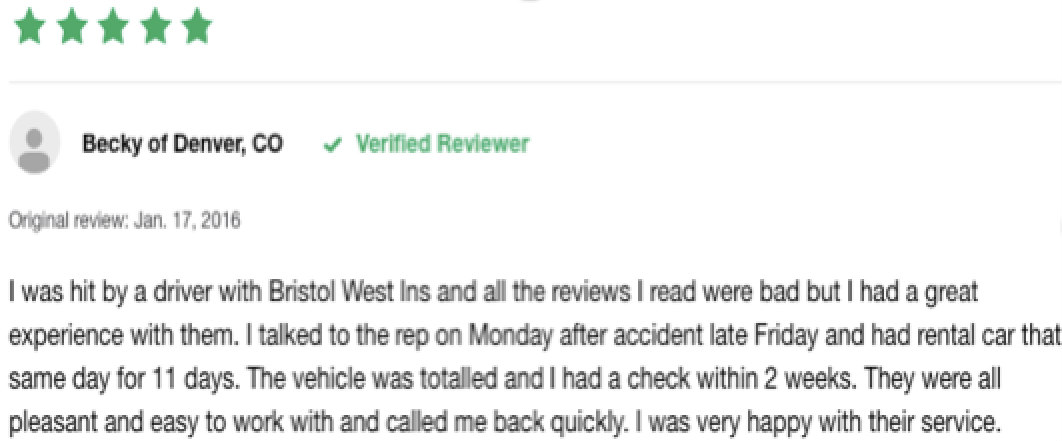

To be fair, Bristol West Insurance also has some good reviews. Check out this glowing recommendation:

See? It’s not all bad news!

Where is Bristol West Insurance going wrong?

It seems like a lot of people just can’t get a hold of anyone at Bristol West Insurance…

…and when they do, policyholders complain that the company takes their sweet time to resolve issues.

There are also some nightmarish stories online about poorly handled Bristol West Insurance claims. Sigh.

Other common complaints include:

- Unexpected fees and increased rates

- Rude employees

Check out some more Bristol West Insurance reviews like the one above if you want to see the experiences that real people have had with this company!

Bristol West Insurance Products Can Only Be Bought From Their Agents & Brokers

Is that right?

You don’t get the benefit of dealing with an independent insurance agency that will compare a Bristol West Insurance offering to competing companies.

…as you know I’m not a fan of using captive agents. They have one goal in mind and that’s selling their company’s policies – whether they work best for YOU or not.

Captive insurance agents are trained on their family of products making them experts in their company policies. They do not have to learn different products and rules of multiple insurance carriers. – TheBalance.com

To top it off, unlike many of their competitors, Bristol West Insurance does not offer online insurance quotes from their website.

So if you’re just looking for a quick estimate, you’re out of luck.

Yeah… a bit disappointing, I know.

Instead, you’ll need to get into direct contact with a local agent in order to get a personalized quote.

Unfortunately, this makes it far more time-consuming to compare Bristol West Insurance rates with other companies.

You’re also required to hand over a lot of personal information to get an idea of what your premiums will be.

Personally, I’m not thrilled about dishing out too much online or over the phone…

…but maybe that’s just me.

It’s Difficult to Compare the Cost of Bristol West Insurance Premiums

…which naturally segues into the next issue.

Because Bristol West Insurance doesn’t offer online insurance quotes from their website, it’s far more time-consuming to compare their rates with other companies.

For me, comparison shopping is one of the most important aspects of getting the best insurance coverage for your PERSONAL needs. So this is a big red flag for me.

So How Can You Compare the Cost of Bristol West Insurance Premiums?

If you want to take a shot at comparing auto insurance prices, you can use this website. But again, you’ll need to plug in quite a bit of information before your ‘quick’ quote can be accessed.

On the bright side, the Bristol West Insurance website, www.bristolwest.com, advertises low down payment options to ensure that their policies are viable for a wider-range of people.

That being said…

Comparing insurance quotes is rule Numero Uno before you buy ANY kind of insurance!

While it’s unfortunate that not all quotes are quick and easy to come by, performing your due diligence will save you some serious cash!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Bristol Life Insurance Company: The Bottom Line

If you’re reading this Bristol West Insurance Review – I bet you want me to tell if they’ll work for you.

Well, you’ll rarely hear me tell clients NOT to go with an insurance company, and Bristol West Insurance is no exception.

Why?

Because there will always be areas where an insurer would be a good solution for a particular client’s individual circumstances.

My best advice?

DO YOUR HOMEWORK. This means employing the assistance of an independent insurance agent that can get you the most accurate information about the companies you’re considering and reading recent articles about the companies that have piqued your interest.

If you get attached to the idea of using one insurance company and work with a captive agent, chances are you are going to pay for it.

You can save some SERIOUS cash by nailing down the right company for your individual needs.

Pros of Bristol Life Insurance Company:

- Specializes in providing personalized auto insurance

- Policies come equipped with collision, comprehensive, and liability coverage (with the option for other add-ons)

- Has an A rating

- Offers low down payment options for people who are strapped for cash

Cons of Bristol West:

- Poor customer support

- The claims department needs improvement

- You have to work with a captive agent to get both quotes and policies

- …which means it’s tougher to comparison shop

My final word? While Bristol West Insurance doesn’t necessarily rank high on my list of insurance companies, they might be a financially stable option for people who want an auto insurance policy but aren’t exactly swimming in dough at the moment.

If you’ve read this far… kudos to you. You’re absolutely doing the right thing by researching companies, rather than getting a policy willy-nilly.

Keep it up!