Level Term Life Insurance | Guaranteed Level Rates

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

UPDATED: Mar 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Term Life Insurance is the most basic and low-cost type of policy you can buy. It lacks the bells and whistles found in permanent insurance policies – but in my humble opinion, these are usually unnecessary!

Guaranteed term life insurance isn’t difficult to understand, but most agents only ever learn about the benefits, not the nuts and bolts of how it really works.

In this article, I will explain everything you need to know to give you a better understanding of guaranteed level term life insurance.

Table of Contents:

What Is Guaranteed Level Term Insurance?

Guaranteed Level Insurance is a form of term life insurance where the premiums are guaranteed to remain the same throughout the policy’s term.

This guarantees that you pay the same price, regardless of how long your policy is active.

Guaranteed Level Premium Life Insurance vs Guaranteed Issue

So guaranteed level insurance refers to level premiums and a level death benefit.

However, it’s important to understand that there is another type of guaranteed life insurance known as Guaranteed Issue Life Insurance.

With a guaranteed issue policy, even if you have terminal cancer, you’re guaranteed to qualify. (although the premiums will be astronomical)

Guaranteed Level Insurance vs. Whole Life Insurance

Guaranteed Term Life insurance differs from Whole Life in that it’s used to cover specific periods of time, whereas whole life insurance is designed to build cash value and cover you for your entire life.

I typically endorse Universal Guaranteed Life insurance rather than Whole Life insurance. For more information, check out my article on Universal Life Insurance.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Best Providers of Guaranteed Level Insurance

Below we provide a review of 3 companies which offer rates through their own online quote search engines:

AIG

With AIG Guaranteed Level Term Life Insurance you can target a policy that is unique to your personal circumstances.

Policy options are available in 17 different policy term lengths from 10 – 30 years.

The AIG search option “Select-a-Term” allows you to customize for almost any situation, benefit amount or length of time.

However, AIG does not search the entire market when it comes to finding the best rate for certain health issues.

Also, another drawback is that AIG Direct provides service through a high volume “call center. Their agents are required to meet quotas, so expect high-pressure sales tactics.

AIG

AIG allows you to customize your Level Term Policy for almost any situation, benefit amount or length of time to fit your personal circumstances.

Zander

Zander Insurance has an easy to use quote engine. However, a variety of users have found that this agency also employs only a limited number of insurers.

If you use their online quote search option, you may find that you only get a finite number of search results and may not find the best quotes at the lowest rates. (For more information, read our “Online Term Insurance: 10 Tips to Help You Get the Best Deal“).

It has, however, been found that they do have the best carriers when it comes to smokers and other health issues.

AARP

AARP specializes in providing term life insurance quotes to people who are 50 years of age and older.

The quotes they offer are for “Level Benefit Term Insurance” and “Extra Protection Term Life Insurance.”

The first problem with AARP quotes is that the level term insurance they offer, increases in price every 5 years.

With other life insurers, rates generally remain the same for the life of the term – we really do prefer Guaranteed Level Term Insurance.

Overall the rates you are quoted on this site may not be the best, especially if you are in good health.

If you are interested in the top overall providers, check out our list of the Best Life Insurance Companies.

Benefits of Guaranteed Term Life Insurance

Wondering if term life insurance is worth buying? Not sure if you need life insurance? Want to know what the benefits of term life insurance are for you?

Here are 5 key benefits of guaranteed level life insurance:

1. Replace Lost Income

If you have a family and are the primary or a significant breadwinner, ask yourself:

“How will my family cope financially if I died tomorrow and they no longer had my income to support them?”

Even though you’re out of the picture, your family will have to continue to survive financially. Bills will still arrive and food has to be put on the table.

If your income is removed from this picture, the effects on your survivors may be devastating. Even if you aren’t the primary breadwinner, but still contribute significantly to your family’s standard of living, the loss of income can be damaging in terms of your family’s financial stability and comfort.

Term life insurance may be used as a means to replace the loss of income should you die unexpectedly.

2. Pay Other Debts

Another benefit of Guaranteed Level Term Life Insurance is that it can cover your existing debts.

A term policy is generally the best life insurance of choice to cover debts. If you’re in debt, you probably need something low cost, and term is the cheapest type of policy out there. Also, most debt will be paid down or off eventually, so you won’t need permanent coverage.

Debts That Indicate You Need Life Insurance Coverage:

- Home mortgage

- Car

- RV or Trailer

- Boat

- Motorcycle or ATV

- Student Loans

- Business Loan or Line of Credit

- Personal Loan or Installment Note

People also get conditional contracts or loans to buy household appliances, furniture or even to pay for the kids’ college tuition.

If you sit back and total up all your debt, you might be in for a rude awakening when you discover how much you owe. It’s probably not a problem as long as you’re working and the income is coming in, but what happens to these debts if you were to die tomorrow?

You might not have to worry about these debts anymore, but your survivors still have to pay for them. Creditors will be the first to be paid out of the estate, before your heirs receive a penny.

3. Additional Benefits For Self Employed

Many people these days are self-employed. They either work from home or operate a small business with one or several employees. So, you earn a good income, have steadily built up your business and are making a comfortable living.

Let me ask this simple question: What will the consequences be if you died tomorrow?

Do you have outstanding business loans? Do you have contractual obligations with clients, suppliers and outstanding accounts that are payable? What happens to your employees?

Then you have to ask yourself what impact will this have on your family…who’s going to pay the estate taxes…what happens to the business and all these outstanding debts and other financial obligations?

This could end up being a legal and financial nightmare for your family.

If you don’t have any form of life insurance, you are potentially exposing them to financial ruin. Term life insurance can be used in a variety of business situations that need coverage.

You can also use term insurance as a quick and simple means to guarantee a business loan. This will make the lender a lot more comfortable when it comes to approving your application.

4. Guaranteed Term Life Insurance is Affordable

One of the biggest benefits of guaranteed term life insurance is that it is so affordable. It can be purchased to suit anyone’s budget.

If you’re between 20 – 35 years of age, are a non-smoker and in good physical health, you can buy a 20 year term with $250,000 in coverage for less than $15.00 per month. A 30 year term policy would only cost you a few extra dollars.

If you need a $1,000,000 policy and are a non-smoking male in good health, you could buy a 20 year term policy for approximately $36.00 per month. That’s less money than you would spend on a single night out with the family or what you might pay for a few restaurant lunches each month.

You might not be able to afford very much right now, but that’s okay because you can also buy an additional term life policy later, when your income increases.

5. Term Life Insurance Is Flexible

Now this section applies to term life insurance, not just Guaranteed Level Term Life Insurance specifically.

One of the best things about term is that it’s flexible. You can choose the following:

- Level Term Policy: Which is for a fixed death benefit & premium

- Decreasing Term Policy: Where you pay a fixed premium but the death benefits decrease at specified time intervals

- Increasing Term Policy: Where both the premiums and the amount of death benefits increase over specified time intervals

The bottom line is, term life insurance is flexible, affordable and provides financial security in a variety of ways.

Read more: Decreasing Term Life Insurance

Guaranteed Level Insurance: Short or Long Terms?

Should I buy a longer Guaranteed Term Life Insurance policy now or, to save money, should I just buy a 10 year term policy and apply for a new one in 10 years?

I encountered this scenario with a 61-year-old client in great health. He was debating whether to buy a 20 year term policy for $500K in coverage for $255.58 per month or a 10 year term policy for $500k in coverage for $132.83 per month. (For more information, read our “What is a 10-year term life insurance policy?“).

My response was that he could certainly apply for a 10 year term now, and then another 10 year term policy in 10 years. And it’s possible that it might be cheaper to do it this way, but I would say it’s very risky.

I just ran a quote for $500K in coverage for a 10 year term policy for a 71 year old and the best price I could come up with was $388 per month! That’s how old this applicant will be in 10 years. As you can see, his savings could be HUGE if he applies now for the longer coverage instead of in 10 years.

Risks of Buying a Shorter Term

- You may no longer be healthy enough to qualify for insurance in 10 years.

- You may no longer qualify for the best health rating, and as a result, pay a higher premium for the same coverage.

- Insurance companies may raise their rates over the next 10 years. (and likely will)

Let’s face it! In your later years, it’s very probable that your health will take some type of downturn. While you may be feeling great today, there is no guarantee that a decade from now this will hold true.

One 20 Year Term Policy vs. Two 10 Year Term Policies

So let’s take a look at how all of these numbers look when using live quotes.

I am going to use the example above: a 61-Year-old Male non-smoker with a preferred rating who just received an offer of insurance by Protective, one of our favorite companies.

If he chooses a 20 year term this is what he will be looking at:

At age 71 this client decides he wants another 10 year term and still qualifies for a preferred rate. He will pay $508.25 per month in premiums. The total outlay for the second 10 year term will be $60,990.00.

So if this client chooses to insure himself for the full 20 years he will pay a total of: $79,087.20

Which means he will pay $10,593.60 more to split the terms up.

…IT GETS WORSE

Let’s say my client finds out he has some health conditions over the next decade that bring him down to a standard rating!

Well, then he would now be paying $737.95 per month. Which would be an outlay of$88,554.00 for the second 10 year term. Which would bring insuring him up to $106,651.20 for 20 years!

A difference of $38,157.60 over a 20 year term, if he decides to keep his coverage and has a decline in health. These decisions are COSTLY!

Why Not Take Both?!

What some people do who are not sure whether to take a 10 or 20 year term is they take consider multiple insurance policies.

For example, the gentleman mentioned above, a male 61-year-old nonsmoker in excellent health, could buy a 10 year term with $250K in coverage for $80.89 per month and a 20 year term for $250K in coverage for $150.07 per month.

Total monthly premiums would be: $230.96 per month

The client could maintain the full $500K of coverage for the first 10 years. After 10 years, he could then let the 10 year policy lapse and would be left paying $150.07 per month for years 11-20 for $250K of coverage.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

What Happens After Your Level Term Policy Expires?

At the end of your Guaranteed Level Term, the policy doesn’t just terminate.

Most term life insurance policies allow you to pay on an annual renewable rate up to age 95 or 100, with no proof of good health required. However, the premiums are dramatically higher than in the initial term.

That’s why you should lock in the longest term coverage you can afford, 30-year term, if you think there’s a chance you’ll need coverage later in life.

A 10-year term policy and is suitable for some people, but remember, when the 10-year term ends, you will face a premium increase. It’s important to plan wisely.

You have three options in most cases:

Annual Renewable Terms Exist

A type of term policy known as an annual renewable term does exist. If you purchase this type of policy, your premiums increase every year.

Annual renewable term is generally less expensive in the earlier years of a policy.

Unfortunately, at some point, your premiums will increase to a rate higher than what you would’ve paid had you purchased Guaranteed Level Term Life Insurance up front.

Most people prefer to “lock-in” their premium for a number of years, which is what makes Level Term Life Insurance attractive.

Sample Guaranteed Level Term Rates

While many agencies shy away from showing sample quotes, we want to give you some quotes without having to provide your personal information.

Most insurers offer Guaranteed Term Life Insurance. When you search for term life insurance quotes online, most are for guaranteed level term life insurance.

20 Year Guaranteed Term Quotes

Here is a brief sample of term life insurance quotes from $100,000 to $500,000 for a 20 year guaranteed term policy.

If you’d like specific quotes for your age and the coverage you want, please use our quote form on the right.

| Age | $100K | $250K | $500K |

|---|---|---|---|

| 30 Years Old | $9.00 | $13.64 | $20.76 |

| 40 Years Old | $10.90 | $17.51 | $29.41 |

| 50 Years Old | $22.14 | $44.01 | $79.20 |

* The quotes above are for a non smoking male who qualifies for the best “preferred plus” rates at various top carriers we represent. They are NOT an offer for insurance. Each individual must qualify based on his or her own health and underwriting process.

If you are reading this and are 20 to 29 years old, you’re in luck.

30 Year Term Rates

Here are some sample guaranteed term rates for a 30 year policy. After all, if you’re 20-29, you’ll probably want a longer term.

| Age | $100K | $250K | $500K |

|---|---|---|---|

| 21 Years Old | $12.31 | $19.65 | $32.35 |

| 22 Years Old | $12.31 | $19.66 | $32.35 |

| 23 Years Old | $12.31 | $19.68 | $32.35 |

| 24 Years Old | $12.31 | $19.70 | $32.35 |

| 25 Years Old | $12.31 | $19.72 | $32.35 |

| 26 Years Old | $12.39 | $19.93 | $32.78 |

| 27 Years Old | $12.48 | $20.14 | $32.78 |

| 28 Years Old | $12.48 | $20.33 | $33.22 |

| 29 Years Old | $12.57 | $20.43 | $33.65 |

Shockingly affordable right?

Did you know that insurance carriers will charge you a different price for every year you live?

So, say you’re 40 years old in good health and you apply for 10 year guaranteed term life insurance for $500,000 in coverage. The true cost to insure you for that one year of life might be approximately $18 per month…but next year you turn 41. You’re one year closer to dying, so it may cost $20 per month.

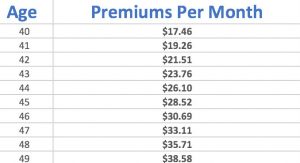

From age 40 to 49, your monthly premiums might increase on a schedule similar to the one illustrated below:

*Figures above are not life insurance quotes by age. They are demonstrating the cost of 1-year term to show how insurance companies average them out to come up with level term premiums.

So you see at its core, guaranteed level term life insurance is like auto insurance.

If you get a speeding ticket or a DWI, your auto premium goes up because you’re riskier to insure. (For more information, read our “How long does a speeding ticket stay on your record?“).

With life insurance, as you get older, you’re closer to death so every year you live, you’re riskier to insure. Which means your premium goes up accordingly.

Occasionally I see Guaranteed Renewable Term policies where the price increases every year, but most people purchase Guaranteed Level Term life insurance.

How Are Guaranteed Level Premiums Determined?

So now that you know the cost of insurance increases every year, I’ll let you in on a secret. The insurance companies don’t raise your premium every year for level term policies.

Rather than increase your premium every year, life insurers take an average of your cost for a block of years, let’s say 10 for example, and charge you a fixed level premium for the entire period.

This premium is guaranteed not to increase during that term.

For example, in the schedule of premiums above from age 40-49, if you add those numbers up and divide the figure by 10, it will come out to about $27.00.

If you’re a 40-year-old and want a 10-year term product, that’s about what you’ll pay. Of course, those numbers hinge on what health rating you get as well.

Is Guaranteed Term Life Insurance the BEST Option?

We agree with experts like Suze Orman and Dave Ramsey who say you should only buy term.

I would agree that 99% of the time, term life insurance is the best choice for most people.

Consider This:

- If you’re planning prudently, you should have no need for life insurance in your 70’s or 80’s

- Term is so inexpensive, you can take your savings (instead of buying whole life), invest it, and almost always come out on top

- Oftentimes people cancel permanent plans because they are too expensive. Term provides affordable coverage you can keep for as long as you need

- You can use term in almost every situation, for example: income replacement, business loans, and key person insurance

Don’t get me wrong, there are situations where permanent life insurance makes sense. You may have lifetime needs for coverage if you have a large estate.

Estate taxes can be a bear and permanent life insurance may be a solution. Or possibly you want to use life insurance for charitable reasons. Once again permanent life insurance comes in handy.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How To Apply For A Guaranteed Level Insurance Policy

It’s like calling a car dealership and asking how much on average it would cost to buy a brand new car.

They’d have to ask you what kind of car you were looking for, color and other preferences. It’s the same when purchasing life insurance.

Long story short, rather than searching for the average cost for life insurance, you can get an accurate quote from a life insurance agent by answering the following questions:

Questions Will You Be Asked to Qualify

- What is your name, date of birth, email address and best phone number to reach you with a quote?

- What is your height/weight?

- Have you used any tobacco products in the past 5 years?

- If so, indicate type and frequency.

- Do you have any current medical conditions or take medication, or have you had any serious medical issues in the past from which you have recovered, such as cancer, heart disease, hepatitis C, etc. (For more information, read our “Can you get life insurance with Hepatitis C?“).

- If you do have a current medical condition, please describe when you were diagnosed, any medications or treatment for the condition, and assess how well it is currently controlled. For serious medical impairments, please see our post on High Risk Life Insurance.

- Other factors that can affect a life insurance rating are history of family disease (cancer or heart disease in your parents or siblings), hazardous occupation, travel or hobbies, or any history of driving suspension or DUI’s, criminal record, history of drug or alcohol use/abuse, or treatment for a mental health issues such as anxiety/depression. If any of these apply to you, let us know.

- Please also indicate the type of life insurance you are seeking (Term, Whole Life, etc.) and amount of coverage you think you need.

So as you can see HEALTH MATTERS!

We Can Help You

Are you looking for Guaranteed Term Life Insurance?

We have a team of agents that know the ins and outs of the life insurance company underwriting guidelines.

Let’s face it, life insurance is not a one size fits all process.

One insurer may work for me – but fail to deliver good rates for you.

Guaranteed Level Term Life Insurance, gives you years of confidence that you are covered and protecting your family.

No matter what your health condition, sleep well knowing your family will be taken care of should something unforeseen happen to you.

It’s best to speak with a knowledgeable independent agent about your guaranteed level life insurance needs! With over 10 years of experience, we feel confident to say that we can find you the best rates in the business.

Call us today at 888-603-2876!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.