Best Mortgage Life Insurance Rates & Tips to Save You Thousands

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Angie Watts

Licensed Real Estate Agent

Angie Watts is a licensed real estate agent with Florida Executive Realty. Specializing in residential properties since 2015, Angie is a real estate writer who published a book educating homeowners on how to make the most money when they sell their homes. Her goal is to educate and empower both home buyers and sellers so they can have a stress-free shopping and/or selling process. She has studi...

Licensed Real Estate Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

You probably already know you should think about life insurance if you have a mortgage.

There are two traditional ways companies have historically tried to sell you mortgage life insurance… but they’re both antiquated and expensive.

In this article, I’ll show you a better way to use life insurance to cover your mortgage

One unique life insurance company has stepped up and developed a brand new custom solution to cover your mortgage life insurance needs. A cheaper and more effective way, one that will neither over or under insure you.

This you gotta see!

Table of Contents:

What is Mortgage Life Insurance?

Old-fashioned mortgage life insurance delivers a policy that starts with the full value of your mortgage and then declines as your mortgage balance decreases.

The good news is you are covered for the amount due on your mortgage as long as you don’t increase your mortgage with a home equity loan, that is!

…BUT it’s a very expensive option, AND you must continue to pay the same premium for the full amount of coverage even though the benefit has been reduced over time.

State Farm’s Mortgage Protection Life Insurance Plan

State Farm is one of the few companies that still offer an old-fashioned Mortgage Protection Life Insurance plan.

For the first 5 years, the death benefit remains level and begins to decline annually as your mortgage is reduced. It never goes below 20% of the original benefit.

Terms are available for 15 or 30 years, and premiums are scheduled to be level for the life of the policy. Unfortunately, State Farm has to option to raise the premiums up to the maximum amount stated in the policy.

Did you know?: Mortgage life insurance policies with decreasing benefits typically cost more than policies with level death benefits.

Sounds impossible, right? It’s because most of them don’t require a medical exam.

Many of these mortgage life insurance offers come via snail mail when a homeowner purchases a new home or refinances their mortgage, and the no exam life insurance company vultures send out their offerings! Typically they cost more than guaranteed level term, but are easier to qualify for.

Comparing State Farm’s Mortgage Protection Plan to Term Coverage

Let’s compare State Farm’s mortgage protection plan with their term coverage:

- For a 44-year-old healthy male, a 30-year Mortgage Life policy with declining death benefit costs $265.46/month or $3,051.50/year.

So, if this man were to die at age 70, the policy would only pay out $238,050.00 (not the full $575,000.00) and by that time, the premiums could be as high as $5,113/year!

This is a very, very expensive policy!

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Guaranteed Level Term Mortgage Life Insurance

It didn’t take the life insurance industry long to figure out that the traditional “mortgage life insurance” policy seen above, with increasing premiums, and decreasing benefits, could easily be beaten by a straight guaranteed level term policy.

MOST agents will sell you this type of life insurance for mortgage protection.

For example, if you have a 30 year mortgage, most agents will try to automatically sell you a 30 year term policy, whose death benefit stays level during the entire 30 years.

Guaranteed Level Term Better, But Not Best!

The benefits of Plan 2 are:

- It’s cheaper

- Your death benefit doesn’t decrease

- You get a longer fixed period of level premiums

Comparing Traditional Mortgage Protection to Guaranteed Level Term

Compare State Farm’s mortgage protection plan above to State Farm’s Select Term policy with a level death benefit:

For the same 44 year old male in good health, a 30 year select term policy costs $149.94/month or $1,723.25/year.

So right off the bat, the policy is cheaper.

Next, if this man were to die at age 70, the policy would pay out the full $575,000 benefit, which would pay off that mortgage, AND provide additional financial benefits for his family.

That’s a great improvement over the cost and the death benefit of their old-fashioned mortgage protection insurance!

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

The Problem with Guaranteed Level Term as Mortgage Protection

Outdated mortgage life insurance plan #1 is easy to qualify for, but its premiums increase and benefits decrease.

Outdated plan #2 is a huge improvement.

Its death benefit stays the same, and it typically saves you money over antiquated mortgage insurance plan #1.

So plan 2 is a no brainer, right?

For many years… yes! But not anymore!

You see, plan #2 has its own problems.

- You overpay for coverage you don’t always need as your mortgage balance decreases

- It’s more expensive than the “better way” I’m going to reveal below

The problem is if you have a 30 year mortgage, most agents will sell you a 30 year term… which happens to be the most expensive type!

The answer? A hybrid of the two old plans!

Here’s how it works.

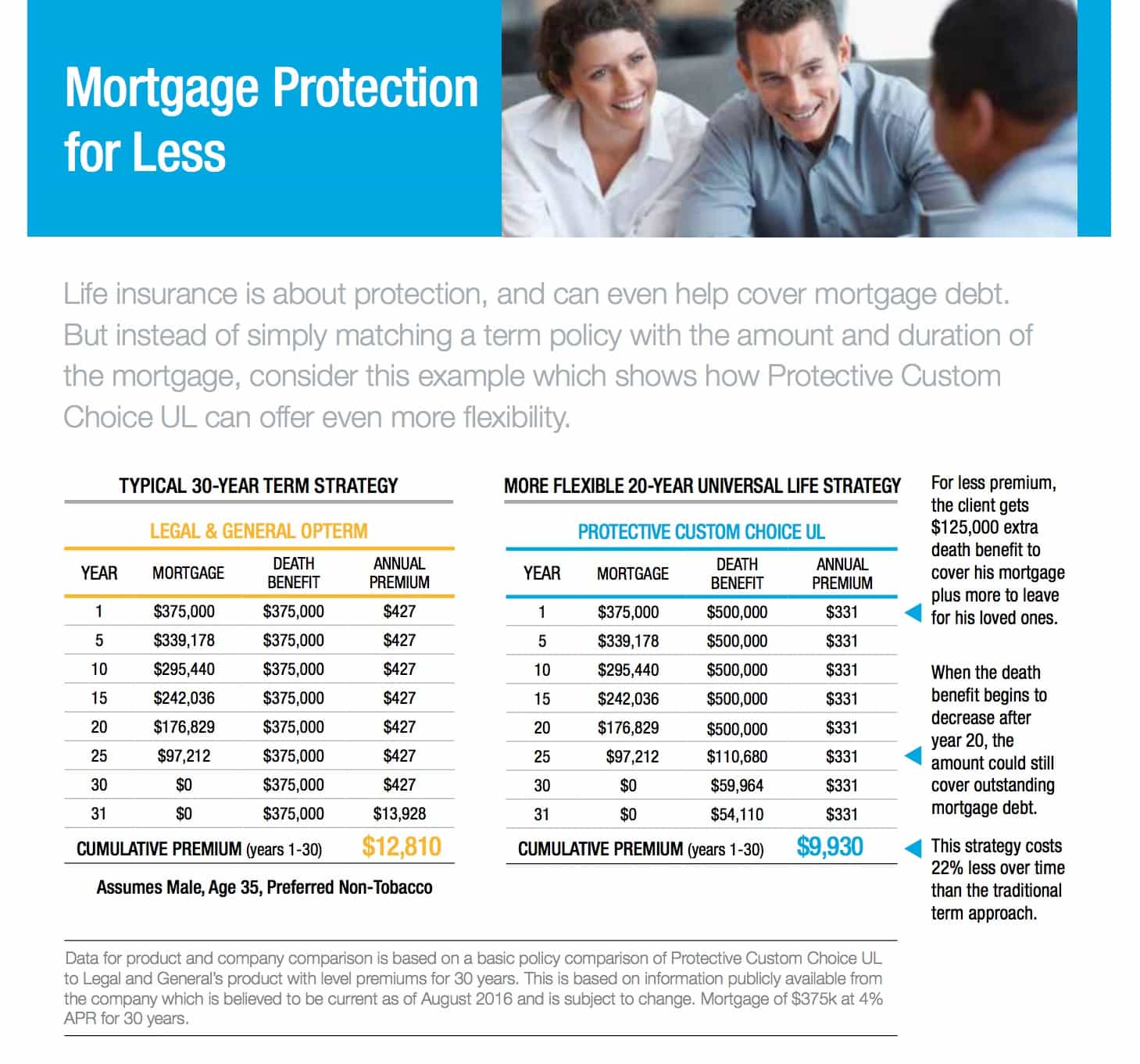

The Best Mortgage Life Insurance Solution: Protective’s Custom Choice Term UL

Protective has THE solution for Mortgage Life Insurance!… a hybrid of the two old plans.

The result?

- Most affordable of all the mortgage life insurance plans

- No overpaying for life insurance you don’t need

- Higher up front coverage than either plan

(Yes, for LESS money)

… the key is, instead of using a 30 year term, you’ll get a 20 year term instead.

To illustrate how it works, here are a few hypothetical numbers…

How Much Does Mortgage Life Insurance Cost?

Let’s say you have a $250,000 mortgage… It will cost you $50 per month to buy a $250,000 policy with a 30 year term.

That’s with a guaranteed level term policy like the “Outdated Plan #2”. Now, I’ll show you how to save 20% with Protective’s Custom Choice UL.

Protective’s Mortgage Strategy

Here’s what we’ll do instead, using a little-known trick with Protective’s Custom Choice Term UL.

- Pay just $40 per month (20% savings)

- Buy a $400,000 (Yes, Higher) policy

- Select a 20 year term, not 30

You see, their Custom Choice Universal Life plan has the magical power to cover your mortgage even after the 20 year term has ended.

So the way it works is this – you purchase a bigger policy, with a shorter term – your experienced independent agent can do the math for you, and when the original term expires, you keep the policy, and continue making your premium payments, meanwhile the death benefit declines until your mortgage is paid off.

Here are some real life numbers:

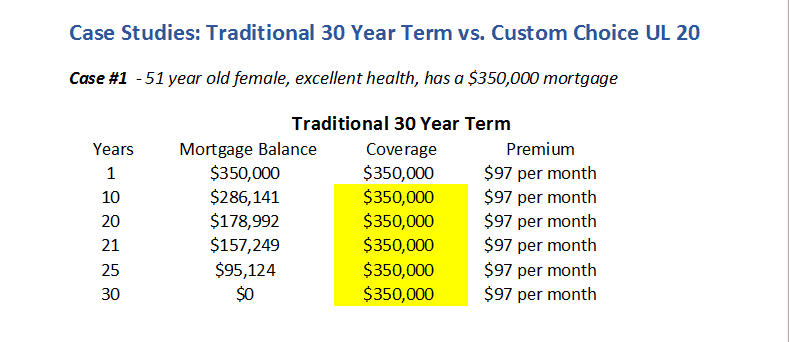

Case Study #1: 51 Year Old Woman Needs Mortgage Insurance to Cover a $350,000 Mortgage

If Ms. Jones, a 51 year old non-smoker with a Preferred Rating has a $350,000 mortgage she needs to protect. She could go with a more-expensive $350,000 Banner Life Term policy for 30 years.

This will cover the mortgage, but will cost her $97 per month for 30 years, a total of $34,920.

That would look like this:

Notice her coverage is much higher than her mortgage balance in the yellow years.

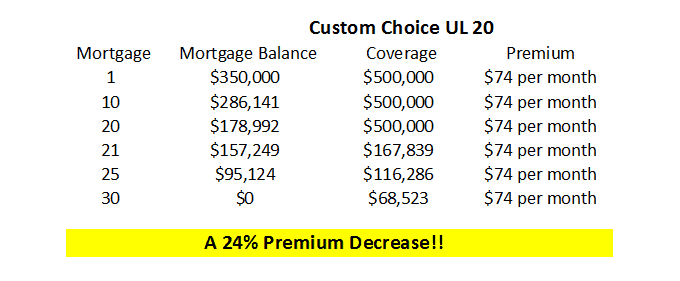

Alternately, she gives the Protective Mortgage Strategy a try, wherein she purchases a $500,000 Protective Custom Choice UL policy for 20 years.

This policy will provide a full $500,000 in coverage for the first 20 years, giving her beneficiary ample funds to pay off the mortgage, plus extra to cover additional expenses.

Then, the policy will continue, with a declining death benefit until the end of the 30 year mortgage. This policy will cost her only $74.31 per month, a savings of over $8,168 over the life of the loan!

Case Study #2: 37 Year Old Man Needs Mortgage Insurance to Cover a $500,000 Mortgage

Now, for a younger person, say a 37 year old non-smoker, male, preferred rating, with a $500,000 mortgage, we find that the old-fashioned policy for $500,000 America General Term policy for 30 years will cost almost $52/month for a total of $18,652 over the life of the policy.

However the Protective Mortgage plan would cost only $44.57/month for a total of $16,045 over the course of 30 years. Any way you slice it, the Protective Mortgage Protection plan is a winner!

How Much is Mortgage Protection Insurance Per Month?

If you want a quote from us for straight term, (old-fashioned type of insurance #2), please see our Life Insurance Rates by Age page, where we offer free ballpark quotes, with no personal information required.

However, if you’d like to protect your mortgage with our new Protective strategy, you’ll need to call us directly at 888-603-2876 for a customized quote, as our quoter is unable to handle these customized rates at this point.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Other Types of Mortgage Life Insurance

Let’s now take a look at some of the other options you may be exposed to if you go to another agency to protect your mortgage through life insurance.

It’s good to familiarize yourself with them so you can make an educated decision when you purchase your policy.

If you read the fine print, you will see that some policies only pay out if you die from an accident!

Your mortgage life insurance policy should be comprehensive, so your family isn’t literally left out in the cold if something happens to you!

Let’s check out some other types of mortgage protection insurance now:

No Exam Life Insurance

This policy is issued regardless of health.

That’s helpful if you’ve have serious medical problems, but no-exam policies usually cost more, so if you’re healthy, you can get more coverage for less money by buying a medically underwritten policy.

Private Mortgage Insurance (PMI)

Here is one big misunderstanding waiting to happen that could cost you your home!

Don’t be confused when your lender includes Private Mortgage Insurance as part of your conventional or FHA loan.

MANY OF THESE POLICIES INCLUDE LIFE INSURANCE ON THE BORROWER, BUT IT DOES NOT PAY THE BORROWER’S BENEFICIARIES. IT PAYS THE LENDER.

These are insurance policies that YOU pay for, but benefit only the lender. Your family receives nothing from these policies. When you are searching for mortgage protection insurance, make sure your family will be the beneficiary, not the lender!

… in other words, even if you have this type of mortgage insurance, you still need life insurance to protect your family so they can continue to pay the mortgage (or pay it off free and clear.)

Level Term Life Insurance

Most agents are now selling level term life insurance policies to clients looking for mortgage protection.

… this was the second “old-fashioned type of mortgage life insurance” we discussed above.

This is not a bad solution, because it will provide enough coverage to pay off the mortgage should the insured die before it’s paid off. The excess death benefit can be used by the beneficiary for other needs and expenses at their discretion.

This policy does not decline, so the value of the purchase remains constant. So it is indeed a better choice than the old-fashioned mortgage protection insurance described above.

However, it may result in over-insurance, which can be costly if not needed. If the balance on your mortgage is only $14,242 when you die, and the death benefit is over $500,000, you may have been paying too much for more coverage than you need.

Mortgage Disability or Mortgage Unemployment Insurance

There is nothing wrong with these policies, per se, but you should know they will not pay off your mortgage if you die.

They only make your payments temporarily while you are unable to make them yourself. They do not take the place of a mortgage life insurance policy!

Additional Mortgage Life Insurance Options

To my understanding, none of these companies offer life insurance for mortgages, at least not in the sense that State Farm does in outdated type #1.

Of course, they all offer term, so all of them are able to “cover a mortgage.”

USAA Mortgage Insurance

In searching USAA’s website for mortgage life insurance, I found nothing more than a page about term life insurance.

Allstate’s Mortgage Insurance

Allstate’s site has a video about paying for a home with life insurance, and a feature where you can customize the term length for the amount of years left on your mortgage. For example, you could buy a 23 year term policy.

… but this appears to be just another version of outdated type 2.

We Can Help You Get the Best Mortgage Life Insurance

Looking for life insurance to help you with your mortgage protection needs? We’ll find a solution that fits your particular circumstances.

Whether you need term or a universal life policy, our well seasoned agents will walk you through your options.

As an independent life insurance agency that offers policies from over 40 of the best rated life insurance companies in America, we are able to offer the most affordable premiums in the industry.

Call Huntley Wealth today at 888-603-2876. We’re happy to answer any questions you have or start your application immediately. We can help!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Angie Watts

Licensed Real Estate Agent

Angie Watts is a licensed real estate agent with Florida Executive Realty. Specializing in residential properties since 2015, Angie is a real estate writer who published a book educating homeowners on how to make the most money when they sell their homes. Her goal is to educate and empower both home buyers and sellers so they can have a stress-free shopping and/or selling process. She has studi...

Licensed Real Estate Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.